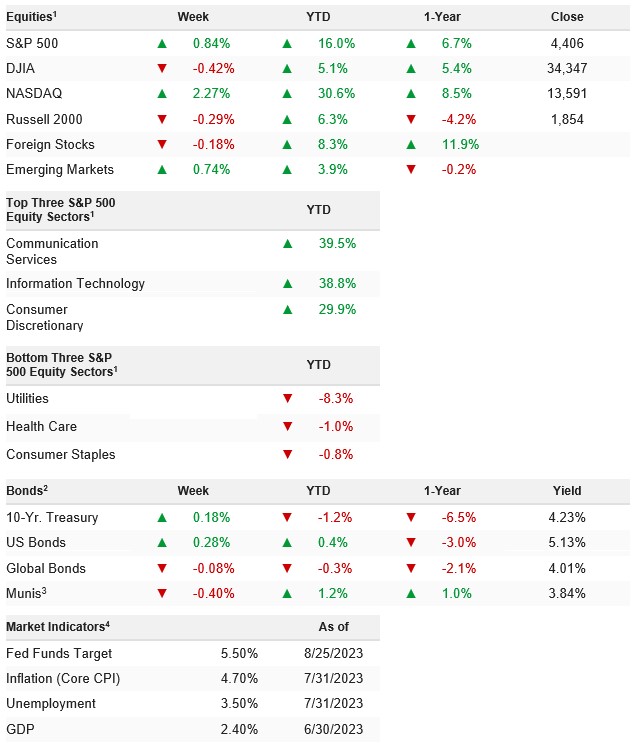

Volatility remained elevated last week as stocks rallied into key mega-cap tech earnings before selling off violently amid concerns about the health of the economy and a stubbornly hawkish Fed. The S&P 500 gained 0.82% on the week and is up 14.75% YTD.

Why Have Markets Suddenly Become Volatile?

The S&P 500 managed a solid gain last week, but volatility continued to rise and there’s good reason for it, as for the first time in months, economic data and earnings commentary implied there are some risks to the “Three Pillars of the Rally” (Soft/No Landing, Disinflation, and Fed Done/Almost Done).

Specifically, the August flash composite PMIs were the first significant data point to hint that the economy is suddenly losing momentum, while high Treasury yields and Powell’s speech (which was hawkishly interpreted even though it really wasn’t on a fact basis) put some doubt into the idea that the Fed was done or almost done with rate hikes.

Considering that the S&P 500 had aggressively priced in essentially no damage to the “Three Pillars of the Rally,” this news has resulted in an increase in volatility, and the S&P 500 has traded back into the “Fair Value” range we identified in the August MMT.

If we get more negative news, namely disappointing growth data that raises hard landing worries, a bounce back in inflation in the upcoming CPI report, or Powell hinting that rates will rise further, then we should expect further declines in stocks as the “Three Pillars” are further eroded.

However, that is not happening right now. On the margin, the “bad” news hasn’t really been that bad, as growth is still solid, inflation is still declining and the Fed is still likely done, or close to done, with rate hikes. Here’s the point: So far, the declines in stocks and the uptick in volatility are more a function of previously unrealistically optimistic expectations and not some sudden, materially negative shift in fundamentals, as that simply hasn’t happened yet.

Going forward, as has been the case for all of 2023, the data will remain the key. This week specifically, if important growth metrics suddenly drop that will challenge the soft/no landing thesis and if, in the next few weeks, CPI doesn’t fall as much as expected, then the disinflation narrative will be challenged—and we will be watching closely for those risks.

For now, while there’s been some erosion of the Three Pillars they are still standing and this pullback/uptick in volatility is more a function of investors more appropriately pricing the current environment, not some sudden reversal of the factors that have underwritten the rally (although again we’ll continue to closely monitor those risks, because if that does happen, it will require getting more defensive, and quickly).

For the first time in what seems like months, economic data was not Goldilocks last week and it challenged (but did not undermine) the “Soft/No Landing” pillar of the rally, and that’s one of the main reasons we saw volatility late last week.

However, not all the economic data last week was bad, and that was also part of the problem. The one part of the economy that investors (and the Fed) want to see some weakness in, the labor market, was strong! Weekly jobless claims declined to 230k and remain stubbornly below levels that would make the Fed less nervous the tight labor market will cause long-term inflation. Point being, it’ll be hard for the Fed to get less hawkish as the labor market remains this tight, so it’ll take a sharp drop in growth (not good for stocks) to get the Fed to back off, as long as the labor market remains this tight.

Bottom line, Goldilocks economic data has fueled this 2023 rally, but data was not Goldilocks last week, and if data continues to roll over, expect more volatility.

Stocks bounced back last week thanks to early week tech strength ahead of NVDA earnings, although a steep Thursday decline made the weekly gains in the S&P 500 more modest.

WEEK ENDING 08/25/2023 (CUMULATIVE TOTAL RETURNS)