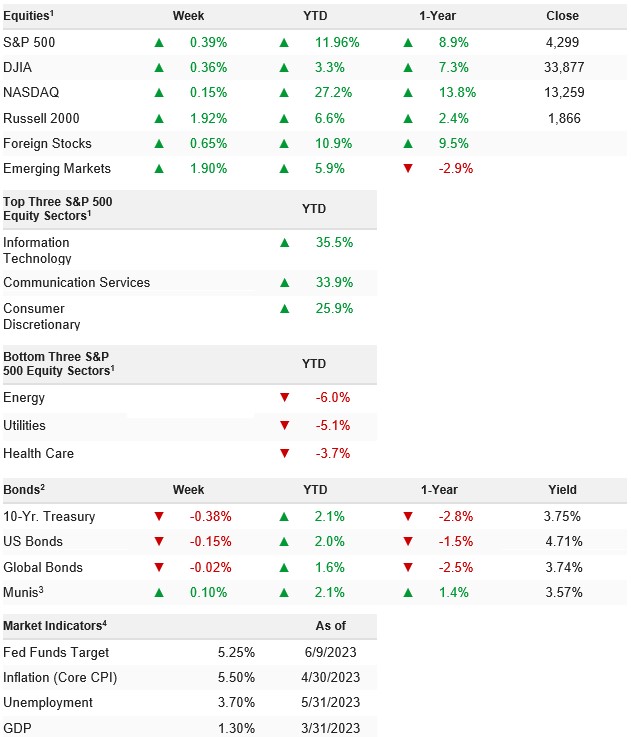

Stocks churned sideways for most of last week as traders assessed the outlook for future Fed policy amid multiple hawkish central bank surprises overseas before a late- week rally saw the broader market hit the highest levels since last August. The S&P 500 advanced 0.39% on the week and is now up 11.96% YTD.

Stocks were resilient again last week and the S&P 500 broke above 4,300 for the first time since August 2022, not because macroeconomic news was good, but instead because news wasn’t bad enough to make investors doubt that a Goldilocks’ scenario of 1) Rapid disinflation, 2) End of central bank hawkishness and 3) Soft economic landing is the most likely outcome.

And we know that because markets ignored actual evidence to the contrary: Economic data (ISM Services PMI and jobless claims) pointed to an economy losing momentum while two significant global central banks (Reserve Bank of Australia and Bank of Canada) surprisingly hiked rates 25 bps and both cited sticky inflation for the surprise hikes! But none of that was enough to break the optimism in markets, as evidenced by the CNN Fear/Greed Index hitting “Greed” levels, and the AAII Investor Sentiment Index becoming the most bullish and least bearish since November 2021.

Looking forward, we know what can push this market higher: More of the same (evidence of accelerating disinflation, not hawkish Fed, solid economic data). Specifically, this week that looks like 1) CPI (and especially Core CPI) solidly under expectations, 2) The Fed pausing rate hikes and markets not believing threats to hike in the future and 3) Solid economic data from Philly Fed, Empire Manufacturing, Retail Sales, Jobless Claims and Industrial Production.

But even if we get that outcome from the data and news, the S&P 500 is facing a real valuation constraint. At 4,300, the S&P 500 is now trading at a 19.4X multiple if we use the 2023 S&P 500 EPS estimate of $223, and a 17.4X multiple if we use the 2024 S&P 500 EPS estimate of $247. Those aren’t “best case” scenario multiples, but they aren’t that far off, either, and even with the bullish momentum currently helping stocks ignore any news that doesn’t fit the bullish narrative, it’s hard to see investors pushing the broad averages materially higher from here (any more than 5% or so.)

Our experience through 2000-2003 and 2007- 2008 continues to make us nervous. Investors operate in days, weeks and months. Markets and economies operate in quarters and years. In both ’00 and ’07, warnings of a looming economic slowdown were wrong for over a year, with those risks all but dismissed by the time the slowdowns actually showed up. We hope this time is different. We hope we do get Goldilocks and we’re talking about new highs in the S&P 500 by year-end. But the reality of 1) High rates for longer, 2) A slowing economy, 3) Pressure on corporate profits, 4) Contracting lending and 5) Slowly rising unemployment can’t be totally ignored, either. So, while we enjoy this resilient market, please keep in mind that under the surface, things aren’t quite as good as the AAII Sentiment Index would imply.

Stocks were little changed last week as markets ignored lackluster economic data and two hawkish central bank surprises, as momentum for equities remains solidly higher (despite the lack of any really bullish news lately.)

WEEK ENDING 06/19/2023 (CUMULATIVE TOTAL RETURNS)