The S&P 500 continued to decline in the second quarter, hitting the lowest level since December 2020 as still-high inflation, sharp increases in interest rates, rising recession risks, and ongoing geopolitical unrest pressured stocks and other assets.

After a rebound in March, the S&P 500 dropped sharply in April to start the second quarter. While some of the reasons for the declines were similar to the first quarter (rising rates, high inflation, geopolitical concerns) the primary catalyst for the April sell-off was something new: a massive COVID-related lockdown in China. Unlike most of the rest of the world, China continues to enforce a “Zero-COVID” policy, whereby small outbreaks are met with extremely intense city- and province-wide lockdowns. At the peak of the recent COVID outbreak and subsequent lockdowns throughout China, it was estimated that 46 separate cities and provinces, impacting 300 million people and representing nearly 80% of China’s economic output were shut in and shut down, essentially halting the world’s second-largest economy. This sharp drop-in economic activity not only increased the chances of a global recession but also compounded global supply chain problems (Shanghai, the world’s busiest port, operated far below capacity during the lockdowns). The severe decline in economic activity in China combined with lingering concerns about rising interest rates and high inflation hit stocks hard in April, and the S&P 500 fell 8.7%.

The selling continued in early May, as the Federal Reserve raised interest rates by 50 basis points at the May 4th meeting, the single-biggest rate hike in 22 years. Additionally, at the press conference, Fed Chair Jerome Powell clearly signaled that the Fed would continue to hike rates aggressively to tame inflation and that weighed on stocks, pressuring the S&P 500 to fall to new 2022 lows in mid-May. But towards the end of the month, markets staged a modest rebound thanks to potential improvement in multiple market headwinds. First, as COVID cases declined, the Chinese economy started to reopen, and by the end of May, the port of Shanghai was operating at 80% capacity, a material improvement from earlier in the month. Additionally, Atlanta Fed President Raphael Bostic stated that the Fed might “pause” rate hikes in the late summer or early fall, and that gave investors some hope that the end of the Fed rate hike cycle may be closer than previously thought. Finally, some inflation metrics implied price pressures may be peaking. Those potential positives, combined with deep, short-term oversold conditions in equity markets, prompted a solid rally in late May and the S&P 500 finished the month with a fractional gain.

But the relief didn’t last long. On June 10th, the May CPI report showed inflation had not yet peaked as CPI rose 8.6% year-over-year, the highest reading since 1982. That prompted a violent reversal of the late-May gains, and the selling and market volatility was compounded when the Federal Reserve increased interest rates by 75 basis points on June 15th, the biggest rate hike since 1994. Additionally, Fed Chair Powell again warned that similar rate hikes are possible in the coming months. The high CPI reading combined with the greater-than-expected rate hike hit stocks hard, and the S&P 500 dropped sharply in mid-June to its lowest level since December 2020. During the last two weeks of the quarter, markets stabilized as commodity prices declined while U.S. economic readings showed a clear moderation in activity and that rekindled hope that a peak in inflation and an end to the rate hike cycle might come sooner than feared. Those factors, combined with the fact that markets had become near-term oversold again, resulted in a modest bounce late in the month, but the S&P 500 still finished with a solidly negative return for June.

In sum, the factors that pressured stocks in the first quarter, including high inflation, the prospect of sharply higher interest rates, geopolitical unrest, and rising recession fears, also weighed on stocks in the second quarter and until investors get relief from these headwinds, markets will remain volatile.

Second Quarter Performance Review

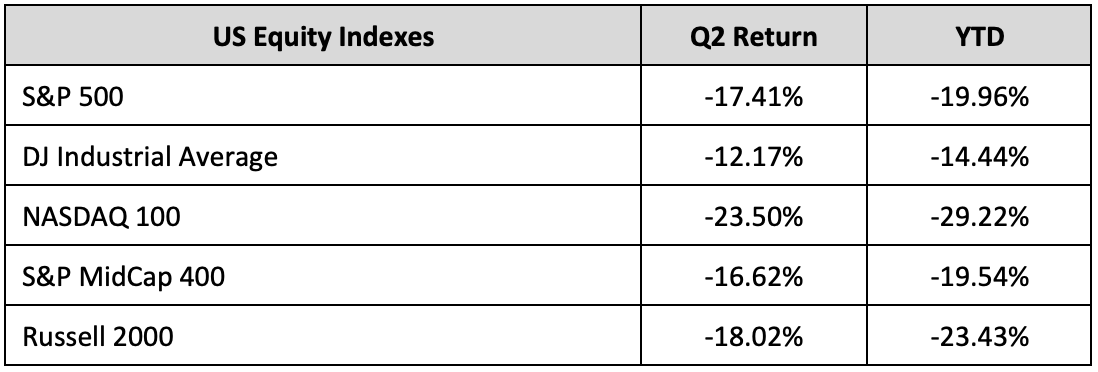

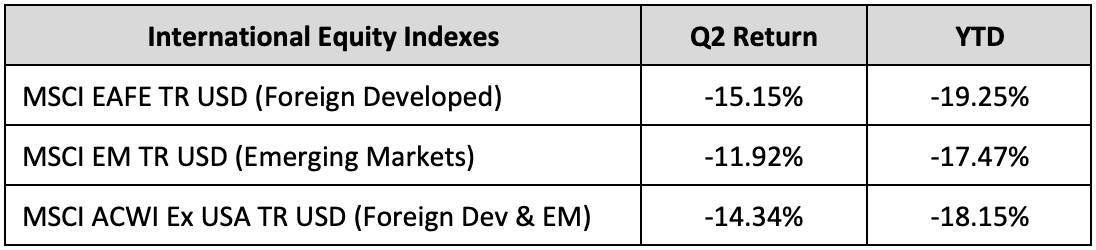

All four major stock indices posted negative returns for the second straight quarter, and like in the first quarter, the tech-heavy Nasdaq underperformed primarily thanks to rising interest rates while the Dow Jones Industrial Average relatively outperformed. Also, like the first quarter, rising rates and growing fears of an economic slowdown fueled the continued rotation from high valuation, growth-sensitive tech stocks to sectors of the market that are more resilient to rising rates and slowing economic growth.

By market capitalization, large-cap stocks again outperformed small-cap stocks in the second quarter, although the performance gap was small. Large-cap outperformance continued to be driven by the rise in interest rates as well as growing recession fears. Small-cap stocks are typically more reliant on debt financing to sustain their businesses, and therefore, more sensitive to rising interest rates than large-cap stocks. Additionally, investors again moved to the relative safety of large caps amidst rising risks of a future slowing of economic growth or recession.

From an investment style standpoint, both value and growth registered losses for the second quarter, a departure from the first quarter where value posted a positive return. However, value did again handily outperform growth on a relative basis in the second quarter. Rising interest rates, still-high inflation, and increasing recession concerns caused investors to continue to flee growth-oriented tech stocks and rotate to more fairly valued sectors of the market, although again, both styles finished the quarter with negative returns.

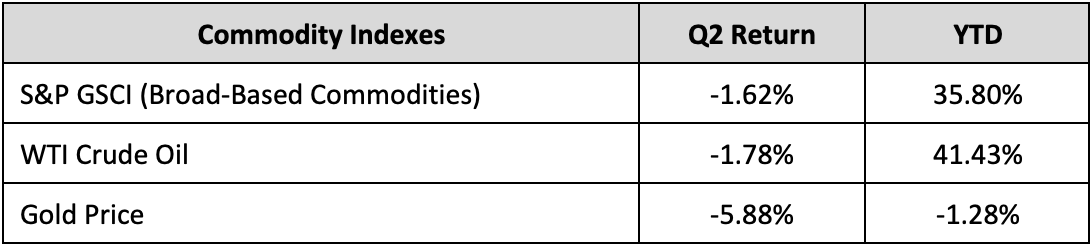

On a sector level, all 11 S&P 500 sectors finished the second quarter with negative returns. Relative outperformers included traditionally defensive sectors such as utilities, consumer staples, and healthcare, which are historically less sensitive to a potential economic slowdown, and the quarterly losses for these sectors were modest. Energy was also a relative outperformer thanks to high oil and gas prices for much of the second quarter, although a late-June drop in energy commodities caused the energy sector to finish the quarter with a small loss.

Sector laggards in the second quarter were similar to those in the first quarter, with communication services, tech, and consumer discretionary sectors seeing material declines due to the aforementioned, broad rotation away from the more highly valued corners of the market. Specifically, internet stocks again weighed on the communications sector, while traditional retail stocks were a drag on the consumer discretionary sector following unexpectedly bad earnings from several major national retail chains. Financials also lagged in the second quarter thanks to rising fears of a future recession combined with a flattening yield curve, which can compress bank profit margins.