Stocks fell to new lows last week amid growing concerns about an economic slowdown in the face of increasingly aggressive central banks around the globe. The S&P 500 fell 5.79% on the week and is down 22.90% YTD.

When could the selling stop?

Stocks were hammered again last week thanks to two main reasons: A bigger-than-expected rate hike and exploding expectations of an imminent recession—those two forces combined with extreme negativity and investor despondency to hammer the major indices to fresh lows.

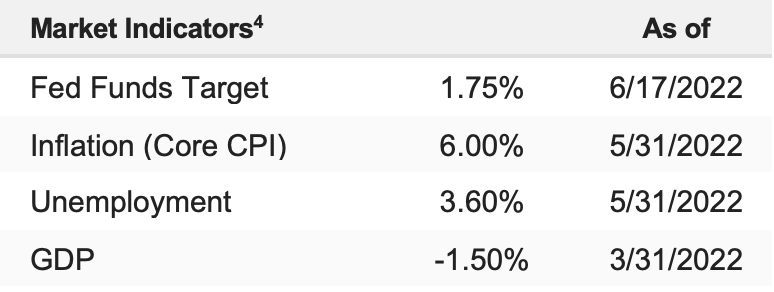

Fundamentally, the news last week wasn’t nearly as negative as the market reaction implied. The Fed hiked 75 bps but didn’t materially increase the “terminal” fed funds rate, meaning that bigger rate hikes mean all this gets over sooner than later (again, it’s the “terminal” fed funds rate, i.e. where they stop hiking, that matters most). Meanwhile, there was plenty of good corporate news last week (although that’s all being ignored).

But fundamental headlines don’t matter in the short term when markets are this negative, and the best use of our time now is determining where this downward spiral might stop.

On a valuation basis, in the June Market Multiple Table, we gave a range of 3,450-3,680, “If Things Got Worse” (and they have). That issue was published on June 7. That range also coincides with the technical measured move target of 3,625, so we should not be surprised if markets stabilize here and there’s an oversold bounce.

Beyond the short term, our “Gets Worse If” target range in the MMT was based on an expected $230/share 2023 S&P 500 EPS. But driven mostly by exploding negativity (not actual corporate results), many analysts are penciling in $220 2023 S&P 500 EPS. A 15X * $220 number gives us a “worst-case” downside target of 3,300 in the S&P 500 or another 10% down from here. We think that is a reasonable “worst case.”

From a catalyst standpoint, our “Three Keys to a Bottom” remain in effect, and none have been elected yet (peak Fed hawkishness, peak inflation, declining geopolitical risk), so we can’t say a bottom is in yet. In the short term, for stocks to bounce from here, oil dropping would be a material positive, as it’d take pressure off inflation metrics and potentially lay the foundation for disinflation in the coming months. If oil can sustainably drop, stocks can rally (but again that’s not a bottom.

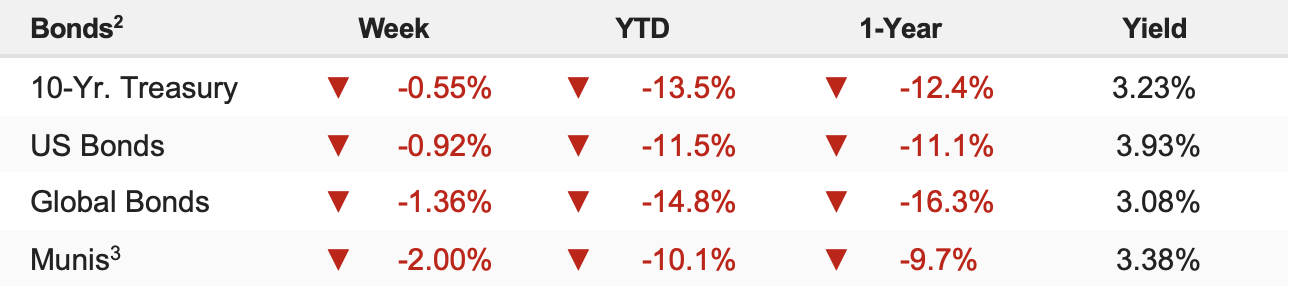

Regarding economic projections, the Fed expects the labor market to remain strong through the end of the year but growth to fall considerably from 2.8% previously to just 1.7% at the June meeting. Inflation expectations were revised up to 5.2% from 4.3% previously but are seen falling back to 2.6% in 2023 and 2.2% in 2024. Finally, Fed Chair Powell said that 75-bps hikes are not going to be typical going forward, which is the comment that the market most strongly reacted to as it rallied to session highs shortly after, but he also noted that a soft landing is becoming increasingly difficult to envision.