Stocks rallied early last week on hopes for a ceasefire in Ukraine but the optimism faded by week’s end on deteriorating rhetoric from both sides. That saw the equity market give back the majority of the gains with traders also digesting fresh economic data. The S&P 500 edged up 0.06% on the week and is down just 4.62% YTD.

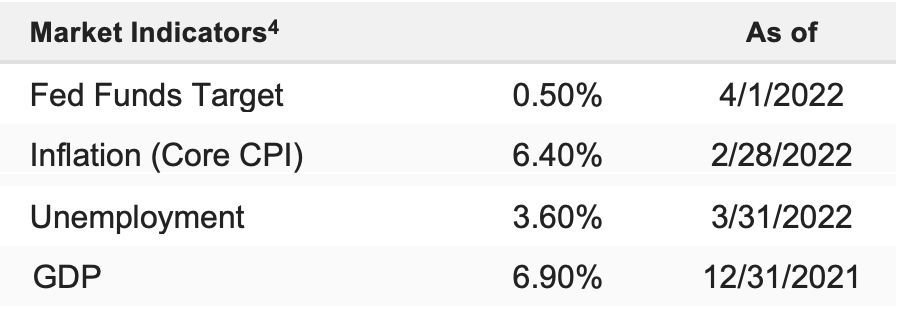

The March jobs report was rather strong and did not alter expectations for a 50-basis-point rate hike in May. Then, the March ISM Manufacturing Index notably missed estimates (57.1 vs. E: 59.0) and stocks fell to new lows for the week. Newswires were mostly quiet for the remainder of the session, which saw stocks bottom in the afternoon and bounce into the close as traders continued to rebalance portfolios at the start of the new quarter while eyeing the deepening inversion in the yield curve.

Staying Focused on What Really Causes Bear Markets

The S&P 500 finished the first quarter down 4% but all things considered, it could have been a lot worse, and the broad markets need to be respected for their continued resilience. Consider that over the past three months: 1) the Fed has massively increased the number of expected rate hikes from 100 bps of tightening in 2022 to 250 bps of tightening in 2022, 2) oil and other commodities have exploded to multi-year highs, adding to inflation and threatening to compress corporate margins, 3) the most heavily owed parts of the market (tech and growth) dropped sharply, and 4) there’s a major war going on in Europe and the whole flow of energy around the globe is about to be reshuffled. With all of that happening simultaneously, we must respect that the S&P 500 is only down 4%.

The resilience does set us up for short-term continued upside if 1) there’s a ceasefire in Russia–Ukraine, 2) the Fed announces that balance sheet reduction will be slower than expected, and 3) the Q1 earnings season is better than feared. While we still view 4,600 as a fundamental valuation “ceiling,” the bottom line is that it shouldn’t shock anyone if the S&P 500 moves through that level by a percent or two.

So, does this relatively impressive market resilience mean that we are too cautious? No, it does not. While the ingredients are there for a continuation of the March rally, it doesn’t diminish the long-term risks building for this market. Generally speaking, the Fed starting a rate hike cycle, a contained regional war, and inflation don’t cause sustained declines in stocks.

Those factors, over time, erode two things: economic growth and corporate earnings. And it’s the drop in those factors that causes sustained declines in the stock market. While we are headed toward both of those eventually, we are not there yet.