Stocks extended the post-March FOMC rally last week as economic data was mostly upbeat, Fed speak was hawkish but offered clarity on policy plans, and the prospects for a ceasefire in Ukraine continued to improve. The S&P 500 gained 1.79% on the week and is down 4.68% YTD.

Have The Real Headwinds on Stocks Even Started Yet?

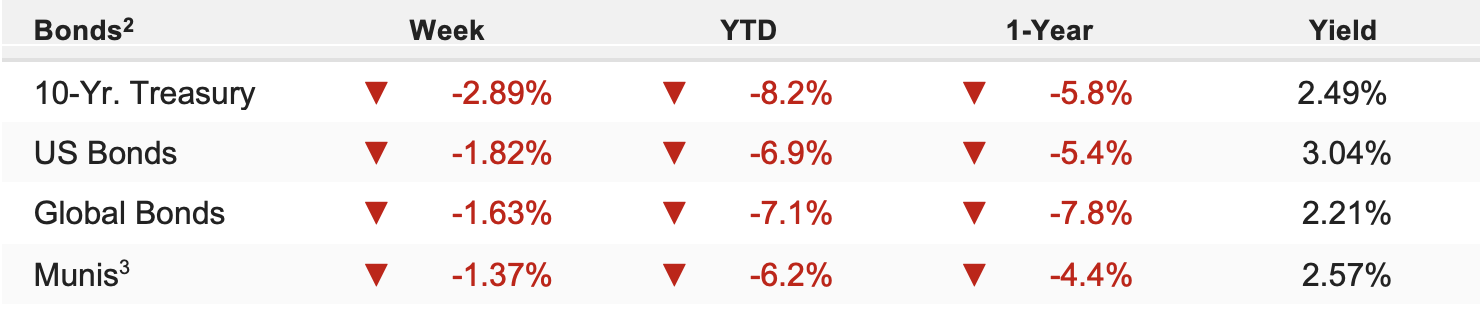

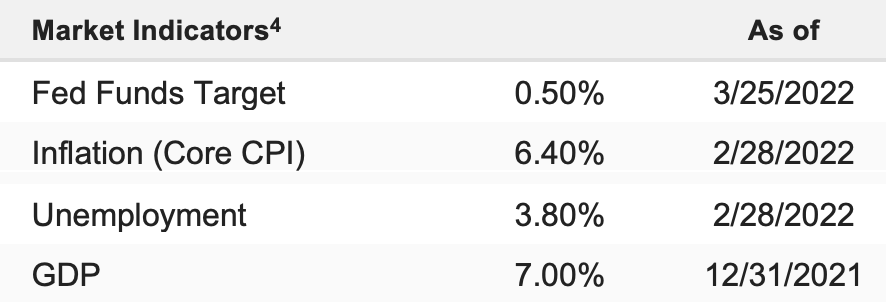

The S&P 500 has traded well off the February lows, and if we consider the headwinds stocks have encountered so far in 2022, the S&P 500 dropping 4.68% YTD isn’t all that bad considering the following: rate expectations have risen sharply compared to the start of 2022 (maybe four hikes to seven or more), inflation has not peaked and is running 7-8%, Q4 2021 earnings season was underwhelming (and positive earnings revisions appear to have stalled), the biggest geopolitical crisis in decades erupted in Europe, oil surged above $100/bbl, and global bond yields are moving sharply higher. So, to a point, we can’t help but be impressed by the market’s resilience.

But there’s just one problem: none of those reasons are why we’re cautious about stocks in 2022. The reason we have been cautious in this market is we’re concerned the Fed has a very narrow path to cooling inflation and not stalling the economy.

Over the past three months, that path has narrowed even more. And, in part due to high inflation, the “Fed Put” remains far below current market levels (it’s definitely below 4,000 in the S&P 500; likely well below). So, while we’re impressed by the relative resilience of U.S. stocks, it’s important to realize that the real headwind on equities—i.e. a slowing economy, hasn’t even started yet.

To use an analogy, if the Fed makes a policy mistake by hiking rates too quickly, it will be the equivalent of an economic storm. From a market standpoint, we aren’t even feeling the effects of that storm yet, which will be: 1) reduced consumer spending, 2) higher unemployment, 3) reduced business spending, 4) falling earnings and 5) reduced multiples. The market is not pricing-in any of that at current levels. Put plainly, the market has been resilient, but the real cause of bear markets (recessions) hasn’t even started yet.

Now, that doesn’t mean we are bears. The Fed has a narrow path to engineer a soft landing, but it’s not an impossible path. Additionally, rates remain very low—it’s likely months (if not quarters) until the Fed hikes enough to choke off growth. In the meantime, this market can still rally. Specifically, if we get a ceasefire in Ukraine soon, don’t be shocked to see stocks rally as oil falls, and the S&P 500 could even trade above 4,600 temporarily.