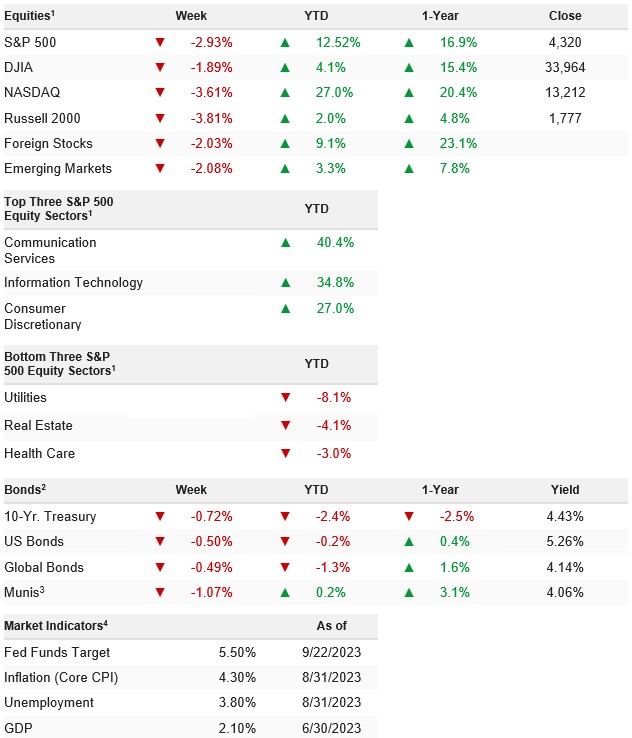

Volatility picked up in a big way in the back half of last week as the hawkish Fed decision roiled markets, sending benchmark Treasury yields to new cycle highs and stocks down to new September lows. The S&P 500 dropped 2.93% on the week and is up just 12.52% YTD.

Stocks dropped last week thanks to rising yields and a more-hawkish-than-expected Fed, but importantly none of last week’s “bad” news jeopardized the three pillars of the rally, and for now, they remain intact (Soft/no landing, continuing disinflation, and the Fed almost done with rate hikes).

The S&P 500 traded down to the lower end of the fair value range we presented in the September Market Mul- tiple Table (4,320) and given current fundamentals, while that level could be broken on a short-term basis by selling momentum, we think fundamentally it should hold beyond the short term.

Put differently, the outlook for stocks didn’t get materially worse last week, but it did get a bit worse and that was reflected in prices. Given the current state of affairs, the issue for this market is more that it lacks a viable upside catalyst, more than anything else. Here’s why:

Economic growth is slowing. That’s not really debatable. But what is very debatable is how much it will slow and, for now, that answer appears to be “not that much.”

Additionally, the Fed is going to keep rates higher for longer. Importantly (and it’s key to understand this distinction) the Fed didn’t get more hawkish last week. For that to happen, the Fed would need to hint at more rate hikes than currently expected and that would be a significant negative. That did not happen. What did happen was the Fed pushed back on the market’s ultimately dovish expectations and emphasized through the dots that it will not be getting less hawkish any time soon. That impacts 1) Investor psychology and 2) Valuations, as structurally higher yields require a lower stock multiple.

Finally, the outlook for inflation is becoming more muddled. Essentially, the inflation optimists are counting on “Immaculate Disinflation,” where inflation magically evaporates while growth doesn’t slow. That doesn’t exactly jive with anyone’s understanding of economics, but nonetheless, that’s what’s happened so far in 2023. The question, of course, is whether that can continue, and there are plenty of reasons to be skeptical.

None of those realities (growth slowing but we don’t know by how much, Fed keeping rates high but not raising them anymore and whether disinflation continues with resilient growth) are directly negative for stocks, because all of them can be resolved positively. However, they also can be resolved negatively, so for stocks to sustainably rally from here, we need more proof each of those three realities will be resolved positively, and we’re just not getting it right now.

So, we’d expect the S&P 500 to remain rangebound in our “Fair Value” level from the September MMT between 4,320-4,560 until such time as the fundamentals imply that either the positive scenario occurs: The economy isn’t slowing very much (or stops slowing), the Fed truly won’t get any more hawkish, and disinflation continues towards target. Or the negative scenario occurs: The economy begins to slow more quickly than expected, the Fed threatens to get more hawkish or inflation bounces back.

We will tell you which one is going to occur, as early as we possibly can, because that will be the time to either 1) Seize an opportunity ahead of a breakout or 2) Get seriously defensive in anticipation of a breakdown.

Stocks dropped last week after the 2024 Fed dot plot was higher than expected (5.125% vs. 4.875%) and as economic data pointed towards stagflation.

WEEK ENDING 09/22/2023 (CUMULATIVE TOTAL RETURNS)