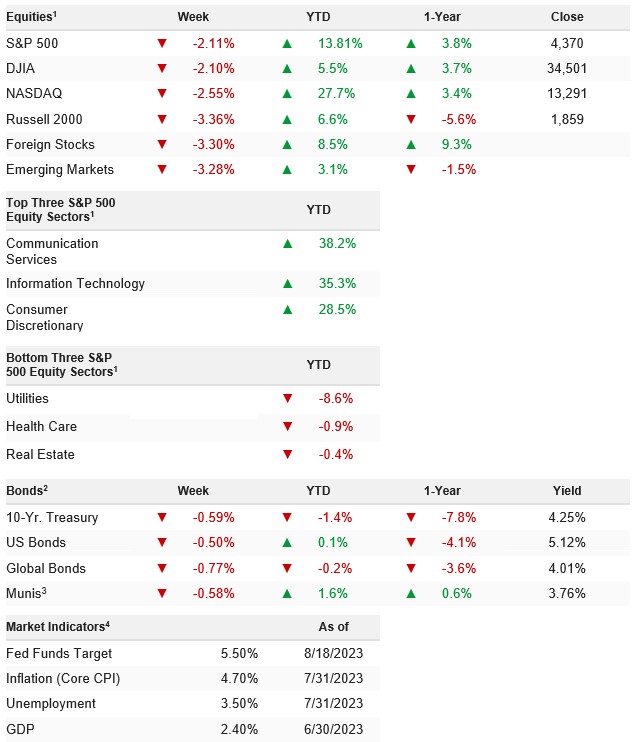

Equity markets remained under pressure last week as strong U.S. economic data resulted in a steady march higher in Treasury yields while data and news flow overseas were notably negative. The S&P 500 dropped 2.11% on the week and is now up 13.81% YTD.

Why the Market is Declining

First, nothing truly bad has happened. The rise in stocks in 2023 has been fueled by better-than-expected economic data (what we call the no landing/soft landing pillar), a sharp drop in inflation (the disinflation pillar) and the Fed being almost done with rate hikes (Fed done/ almost done pillar). Positively, none of that has changed since stocks started to decline a few weeks ago. However, the market did get ahead of itself in expecting more good things to happen, and now that they aren’t, we’re seeing some of that given back.

Think of it this way. Markets started 2023 way down with investors and Wall Street expecting an imminent recession and high inflation. But while the economy is slowing, it’s not slowing as quickly as everyone thought. Meanwhile, inflation is still high, but it’s dropped more quickly than everyone thought. Both inflation and growth were not as bad as feared, and that data combined with negative expectations to spark a solid (and warranted) rally in stocks.

Then, starting around July, investors began to act like a slowing economy wasn’t happening (it is) and inflation was about to crash back to normal (it isn’t). That very optimistic view (essentially that all our troubles were over) sent the S&P 500 to about 4,600.

But just like investors were too negative to start 2023 (and it presented an opportunity for a rally), investors got too positive in July (and it presented an opportunity for a pullback), because actual economic data can’t back up the “our troubles are over” type market. Now we are seeing the S&P 500 more appropriately reflect the current reality: Economic growth is still resilient, but we must acknowledge that it’s slowing and account for some possibility that it gets worse. Inflation has fallen, but we must account for the fact that it could level off solidly above the Fed’s 2% target. And the Fed is almost done with rate hikes (or already done) but they likely aren’t reducing rates anytime soon, so we will have to learn to live with 7% mortgages, etc.

That isn’t a “bad” environment, but it isn’t one that justifies the S&P 500 near 4,600, and that’s why it isn’t near 4,600 anymore. The market of 2023 is being defined almost by hyperbolic extremes. We started 2023 with investors fearing a catastrophic recession, 1970s- style inflation and 1970s-style rate hikes. That hasn’t happened. But just because that didn’t happen, it doesn’t mean that: No economic slowdown will occur, inflation will magically crash to late 20-teens levels, and the Fed will suddenly turn dovish (as markets priced in at 4,600). The truth is in the middle, and that’s where we are now. And while the fundamental outlook is still supportive, we should all brace for more volatility in the near term (but that volatility doesn’t mean everything is bad again). From a “what to do” standpoint, there’s no major fundamental shift that implies it’s time to drastically reduce stock holdings, and while the pullback likely isn’t over there’s no reason yet to think this is anything more than consolidation of the 2023 rally.

Bottom line, last week’s data was solid, plain and simple, and there is no evidence that the U.S. economy is losing momentum at this point, and that reinforces the soft/no landing scenario. But it’s also helping to push Treasury yields higher (which is a headwind on stocks).

Stocks extended the recent pullback last week as a continued rise in Treasury yields along with growing Chinese economic worries weighed on stocks broadly despite better-than-expected corporate earnings.

WEEK ENDING 08/18/2023 (CUMULATIVE TOTAL RETURNS)