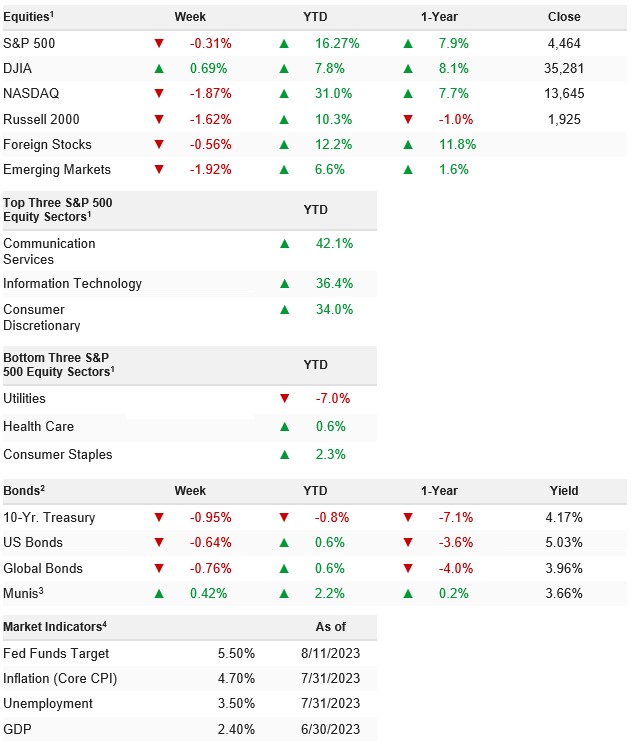

Stocks churned sideways last week as investors digested data that offered mixed signals regarding inflation trends. A steady rise in the 10-year yield presented a headwind to the broader market and the S&P 500 fell 0.31% on the week leaving the index up 16.27% YTD.

What Can Push Stocks Higher from Here? (Four Candidates)

Stocks declined modestly last week but the three pillars of the rally remained firmly in place, as CPI showed continued disinflation, economic data still pointed to a soft landing, and Fed commentary still implied the Fed is done with rate hikes (or almost done). But as we and others have covered, simply further confirming the three pillars remain in place isn’t enough to push stocks higher as that’s already priced into markets. That leaves the market vulnerable to mild disappointments that result in market declines (which is what’s been happening for the past two-plus weeks).

So, what can reignite the rally and help push stocks higher from here? There are four candidates:

1. Treasury yields declining modestly. We don’t want Treasury yields to collapse, as that’d signal a hard economic landing. But a drift lower, especially in the 10 year, would help support the market multiple and make the argument for a 20X valuation (up from the current 19X) more viable. This could come from either Powell confirming that the Fed is done with rate hikes at Jackson Hole, or in-line economic data and a continued decline in inflation readings.

2. Better than expected earnings. If multiple expansion is basically exhausted, then it’s up to increased earnings to push stocks higher. Current 2024 S&P 500 EPS expectations are about $240. If corporate commentary pushes that number to $250 (or even slightly higher) that makes 4,750 (which is earnings of $250/share times a 19X multiple) a legitimate target. This week, we get important earnings updates from HD, TGT, WMT, EL and AMAT and they will include July economic commentary, and positive news about consumer spending will be positive for markets. More importantly, are the NVDA earnings on Aug. 23. The last NVDA blow out earnings ignited the summer rally, and another strong report will help boost S&P 500 earnings expectations.

3. A Change in Sentiment. Negative sentiment is the unsung hero of the 2023 rally, as negative expectations never materialized, leaving most money managers to chase stocks higher. Now, it’s flipped, where higher stock prices are the consensus expectation. If the market stalls, or modestly pulls back, then sentiment can become more negative and give us that perception gap that can lead to a rally. We’ll be watching the sentiment indicators for any evidence of this.

4. Surprise good macro news. An improvement in the U.S./China relationship, large-scale Chinese economic stimulus, or a ceasefire in the Russia/Ukraine war would all provide a surprise boost and reduce global recession chances, and that would help lift stocks.

Bottom line, the near-term outlook for markets remains solid as the three pillars remain in place, but we need something new to resume the rally because currently the market is just treading water, and it’ll remain susceptible in the near term to any incremental bad news modestly pressuring markets.

The S&P 500 fell to a one-month low last week thanks mostly to a continued rise in longer-dated Treasury yields, as the rally in yields is adding a stiffening valuation headwind to markets.

WEEK ENDING 08/11/2023 (CUMULATIVE TOTAL RETURNS)