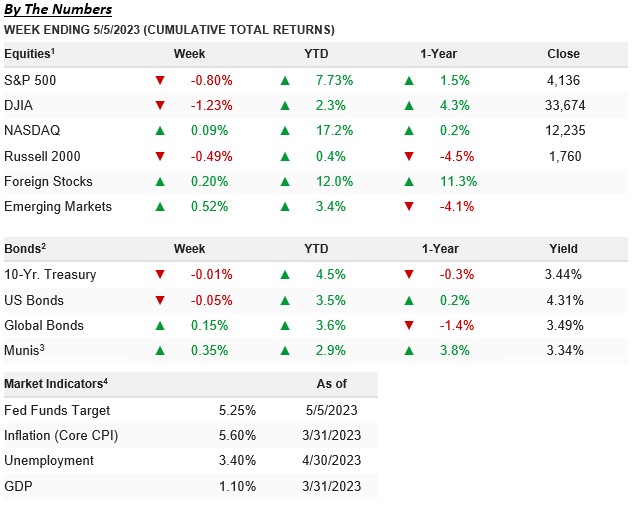

Stocks were volatile last week as investors parsed through more mixed earnings reports, mostly upbeat economic data, a largely as expected Fed decision, and more regional banking sector turmoil. The S&P 500 fell 0.80% on the week and is now up 7.73% YTD.

The Fed Pivoted, So What’s Next?

Last week brought the fulfillment of multiple events the market had been watching, including the FOMC decision (the pause), key April economic data (hard landing/soft landing) and Q1 earnings (which are basically over). So, given what’s happened, we want to step back and update the state of each event, and identify what happens next.

Fed Policy. What Happened: The Fed paused. Market Impact: Neutral. This was already priced in so it helps support stocks but won’t push us materially higher. What’s Next: Barring a jump in inflation, when does the dovish pivot occur (sooner the better)?

April Economic Data. What Happened: Data was generally “fine” and did not signal a hard landing (although it left the possibility for one intact). Market Impact: A hard landing remains the biggest potential negative for stocks, so the fact that data did not imply a hard landing helped support stocks last week. What’s Next: This week’s CPI report, and then the May economic data (the hard landing vs. soft landing question remains the most important issue for markets).

Earnings. What Happened: The Q1 earnings season was better than feared, with a high number of companies (more than 70%) beating estimates. Market Im- pact: Neutral. Earnings are helping to support stocks, but guidance wasn’t great, and earnings season won’t push the S&P 500 Full year guidance didn’t match higher. What’s Next: strong Q1 performance (more on that this week) and guidance will have to be increased for earnings to be a tailwind).

In sum, the events of last week largely came out “ok” for markets and imply that the March and April rally was mostly valid, so that’s a positive. However, it’s important to realize that risks on the horizon didn’t dissipate. Even after the Fed decision, Q1 earnings and April economic data, we don’t know, for sure, if: 1) The Fed will actually cut rates this year (if not, that’s a negative), 2) If earnings can hold up (Q1 results were good but guidance was not, that’s a potential problem) and 3) The economy can maintain this soft-ish landing.

Bottom line, the Fed pause, Q1 earnings and May eco- nomic data were “ok” and net positive for stocks, but most of them were also already priced in and they don’t remove the possibility of future negatives. As such, we continue to think a cautious approach centered on large- cap defensives and tech, minimum-volatility ETFs remain the best way to maintain long exposure, but also account for the fact that none of the major issues that could cause a sharp market decline have been eliminated.

Stocks dropped moderately last week as a Friday rally driven off solid earnings and a Goldilocks jobs report offset more regional banking worries.

WEEK ENDING 05/05/2023 (CUMULATIVE TOTAL RETURNS)