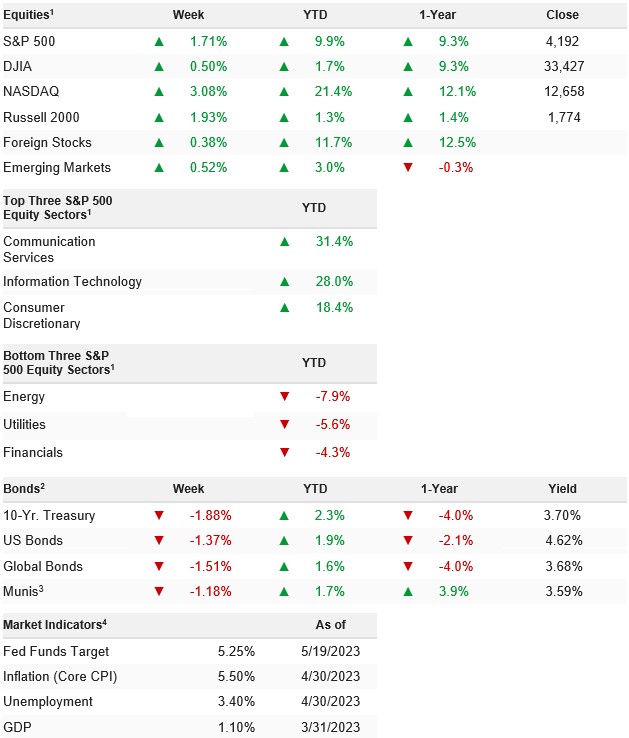

Stocks rallied to new 2023 highs last week as optimism about a debt ceiling deal offset a hawkish shift in Fed policy expectations and lingering recession worries. The S&P 500 rallied 1.65% on the week, extending the 2023 gain to 9.18%.

For the past several weeks we’ve stressed that the market’s performance must be viewed in the context of what investors think will happen, and it’s the deviation from that expectation that creates the “pain trade.”

For all of 2023, due to a long and substantial list of risks facing the markets, investors (especially institutional investors) have expected stocks to decline (this is backed by multiple sentiment and investment surveys from throughout the year). But as those risks have failed to materialize, it’s caused the “pain trade” to be higher as underinvested managers chase returns higher, and that is exactly why the S&P 500 hit the highest level since August last week.

Put in plain English, money managers expected stocks to extend the losses from 2022 as more bad “stuff” would happen (recession, earnings declines, debt ceiling, high- er rates, high inflation, etc.) However, those bad things haven’t happened yet, and that has caused stocks to lift and for the rally to be fueled by “chasing.”

Again, that was the case last week. Economic data clearly showed the economy is losing momentum, but still mostly pointed to a soft landing. Earnings from major retailers pointed to more restrained consumer spending focused on staples and low-margin items, but not a sudden collapse. The debt ceiling negotiations showed progress and made a debt ceiling breach less likely. All those events are not as bad as feared.

However, it’s important to remember that none of them are “good” either. Economic growth is clearly slowing and that’s really not good for anything. It’s now just a question of by how much (and we won’t know that for at least another few months). Earnings growth is challenged, and while companies are navigating it well so far, the slowdown is just in the early innings. Finally, the debt ceiling has shown progress, but there’s no deal yet and we’ve got less than 10 days until the “X” date! Finally, the Fed has likely paused rate hikes, but the market is expecting cuts by year-end, and there was some serious pushback on that idea last week from Fed officials.

Bottom line, not-as-bad-as-feared events have largely fueled the YTD rally and that can continue, especially if the S&P 500 can sustainably breakout to new highs because that will create more “chasing.”

But “not as bad as feared” cannot support a sustainable rally (one that lasts for quarters). Point being, the “pain trade is higher,” but at this point it’s long in the tooth. And while it’s not over, it can’t push the S&P 500 sustainably into the mid 4000’s (the valuation will get too stretched).

Instead, we need actual positive resolution from these events, i.e., clear soft landing (that doesn’t pressure the market multiple), earnings stability (which keeps valuations reasonable), Fed debt ceiling deal, and Fed confirmation that rate cuts are coming sooner than later (the sought-after pivot).

We’ve advocated maintaining small, long positions throughout 2023 given our recognition that despite numerous risks to markets, investors’ expectations were already very cautious. But we also must account for the fact that those risks are still real (hard landing, earnings drop, more- hawkish Fed) and our experience from ’99 and ’07 gives us one clear lesson: These risks can take longer to appear than anyone appreciates, but just because they haven’t occurred yet doesn’t mean they won’t occur.

Our preferences for conservative long positions are staples, utilities, super-cap tech, minimum-volatility funds. When these macro risks are materially reduced, it’ll be time in our opinion to get more aggressive. But while momentum is clearly higher, the macro risks facing this market haven’t been reduced so far in 2023, they just haven’t happened, and that’s important context to keep in mind.

Stocks rallied to multi-month highs last week on not-as-bad-as-feared economic data and on apparent progress on the debt ceiling, and despite hawkish Fed speak.

WEEK ENDING 05/19/2023 (CUMULATIVE TOTAL RETURNS)