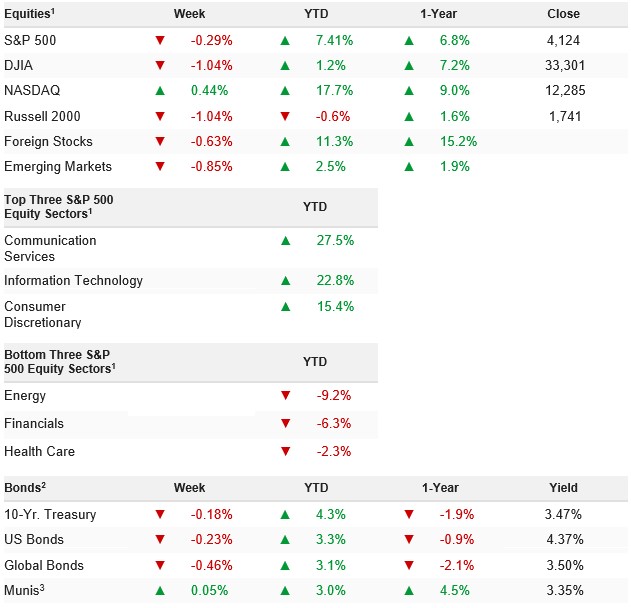

Stocks were pinned within a tight range last week as traders continued to weigh debt ceiling drama against the health of the regional banking sector and lingering concerns about inflation and global growth. The S&P 500 ended the week down 0.29% and is now up 7.41% YTD.

Stocks opened last Friday’s session higher thanks to optimism that a deal on the debt ceiling may be reached as early as the beginning of this week. The market was quick to roll over, however, as the University of Michigan’s Consumer Sentiment release was universally bearish for risk assets with the headline missing estimates while the all-important inflation expectations figures jumped well beyond estimates (the five-year expectations level hit the highest since 2011). Policy expectations took a mildly hawkish shift over the course of the day, but stocks stabilized and recovered as traders positioned into the weekend. The S&P 500 dipped 0.16%.

Stocks proved resilient yet again last week, as the S&P 500 saw only a modest decline despite more bank stress (PACW), another rate hike from the Bank of England, a pop in jobless claims and a drop in consumer sentiment. The reason these negatives didn’t create a bigger move lower is clear: They don’t make the big risks in this market more likely, and so several material risks to the market will remain on the periphery.

Put differently, there’s no shortage of things that can go wrong with the economy and markets. A hard landing may occur. The Fed may keep hiking rates. Inflation may not decline. Earnings guidance may get cut. The debt ceiling may be breached.

In normal times and in normal markets, this formidable list of potential negatives would pressure stocks. But context matters, and after experiencing the worst year in the market since the financial crisis in 2022, and with the S&P 500 still nearly 20% below the all-time highs, in 2023 the market has adopted a “show me” state of mind. Put more bluntly, all those risks mentioned above may happen, but until it looks like they actually will, the combination of 1) The 2022 drop in stocks and 2) Continued broad expectation of calamity by the majority of investors is combining to support markets, as the news simply isn’t bad enough, yet, to cause material selling.

As we’ve learned very clearly during my time in this business from 2005-2007, just because something bad hasn’t happened yet, it doesn’t mean it won’t. The net result, we believe, is that we must respect this market’s resilient nature by staying long, but we must do so by controlling downside exposure, and that’s again done via defensive allocations across minimum-vol ETFs.

Looking forward, economic data remains the key. We know that’s not the most exciting topic, but we will continue to watch the data very closely for you over the coming weeks and months because that hard vs. soft landing question is the question that decides the next 10%-20% in this market, and we are going to make sure you get it right, as early as possible.

Stocks dropped slightly last week as jobless claims rose to a one-and-a-half-year high and PACW issued a very disappointing deposit report, although markets proved resilient and closed with only modest losses.

WEEK ENDING 05/12/2023 (CUMULATIVE TOTAL RETURNS)