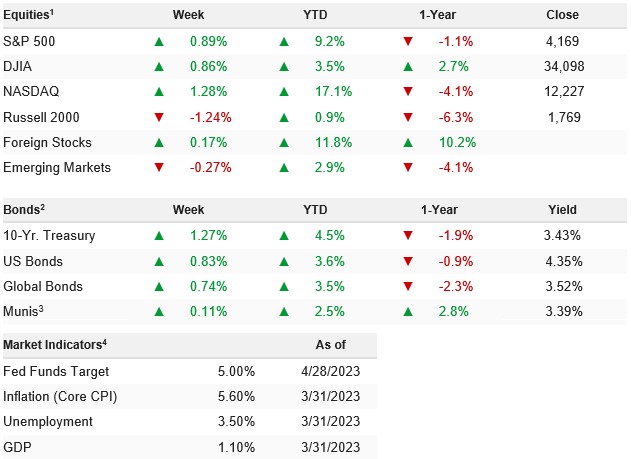

Stocks were volatile last week as solid big-tech earnings later in the week helped offset the recently increasing worries about a looming recession. The S&P 500 ended the week with a gain of 0.87% and is now up 8.59% YTD.

Moment of Truth: Will the Fed Announce the Pause?

Ever since mid-March, when SVB and SBNY failed, markets have taken the additional headwind on the economy from regional bank stress to validate the following Fed script: Hike 25 bps in May, but announce a pause in rate hikes. Then, in late summer, as growth slows and inflation falls, the Fed announces a “pivot” towards less-hawkish policy, and rate cuts occur in the fourth quarter.

This expected path for Fed policy has not only propelled the S&P 500 to the very top of the “reasonable” valuation spectrum and produced solid returns YTD, but it also has allowed markets to “look past” economic data and earnings guidance that is sending very mixed signals about whether this economy is headed for a soft or hard landing.

Now, it’s time for the Fed to meet the market’s “hike/ pause/pivot/cut” expectation. If they do, then that will 1) Solidify the YTD gains and 2) Opens the possibility of an extended rally if the economic data points to a soft landing (up to 4,300 or perhaps above).

If they do not meet that expectation, then the stock market is “over its skis,” and it opens the possibility of a potentially sharp and painful drop (easily 5%) as 1) The market multiple will fall given the risk of additional rate hikes, and 2) The chances of a hard landing will rise as the Fed puts continued pressure on growth via higher rates.

Tactically, the market remains resilient and sentiment remains very negative, so we continue to want to maintain long exposure. However, we still prefer defensive/ low-volatility positioning, because our main medium-term fear is that hard landing, and minimizing and avoiding the fallout from that possibility (which could easily be 10%- 20% drop). We prefer large-cap exposure with a tactical focus on high free cash flow companies and defensive sectors until such time as the economic out-look becomes clearer (and when a hard landing isn’t such a big risk).

Bottom line on growth, as we said last week the data is extremely conflicted, with some reports pointing to sudden weakness, and other reports implying strength. That’s typical of economies that are approaching a transition from growth to contraction (or contraction to growth), and this mixed data continues to have us weary that the economy is going to slow in the coming months.

Stocks rallied modestly last week thanks to strong mega-cap tech earnings, which helped offset the increased risk of a FRC failure, mixed earnings, and hotter-than- expected economic data.

WEEK ENDING 05/01/2023 (CUMULATIVE TOTAL RETURNS)