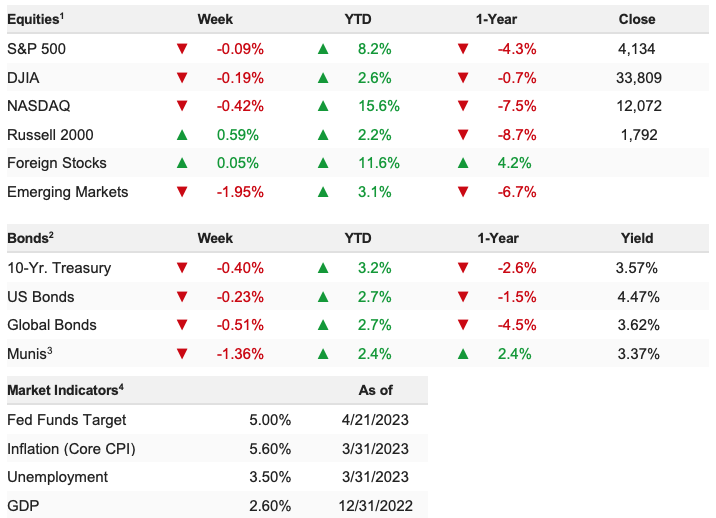

Stocks largely churned sideways last week as investors assessed Q1 earnings reports, mixed economic data, and a still-hawkish tone from Fed officials. The S&P 500 dipped 0.10% on the week and is up 7.66% YTD.

The market was choppy and volatile in morning trade Friday as investors digested a relatively solid Composite PMI Flash in the U.S., which largely tracked the good PMI data points in Europe from the pre-market. Yields turned higher and stocks dropped to new lows for the week before the sideways price action that dominated markets all week resumed into the middle of the day. The S&P 500 ended higher by 0.09%, and near session highs.

Is Conflicting Data Signaling a Looming Shift in the Economy?

The number of mixed signals in this market has been elevated since the pandemic, but it’s gotten worse over the past few weeks (and especially last week). It’s almost as if the same data is looking at two different economies. Certain reports imply solid growth (Empire and Flash PMIs), while others signal a sharp slowdown is occurring (Philly and leading indicators). Some earnings commentary talks about a resilient economy (materials companies such as NUE), while others warn of a looming intense slowdown (CDW). Headline inflation is falling, but core inflation is stable (if not rising). Fed officials are committed to hiking rates in May and are openly saying there will be no cuts this year, yet the market has two to three cuts priced in.

In our experience, this level of divergence in the data and other reliable market indicators usually comes at a “turn” in the economy (or markets). Some reports are looking at the current economy (fine growth) while others are looking at the coming economy (slowing growth). And since this economy is still solidly in growth mode, our concern remains the “turn” will be towards no growth (or more likely) a contraction.

Now, that concern aside, the resilient nature of stocks must still be respected. There was a lot of potentially negative news last week, yet markets only modestly declined. Again, we think bearish sentiment, hope for Fed rate cuts and hope for a soft landing are supporting the market, and while we are concerned that won’t last, for now it must be respected.

Bottom line, the conflicting signals from data, earnings, Fed speak, inflation, etc. only reinforce our concern the economy is “turning,” and as such we continue to want to be positioned for slower growth ahead, and that means defensive sectors (utilities/staples/healthcare) and lower-volatility (USMV), super-cap tech (TDIV). If growth slows, these sectors will outperform and insulate clients from volatility. And if the soft landing happens and we get “immaculate disinflation” (dropping inflation without any economic slow- down) then we’re still long equities, and while they might relatively lag, they’ll still rally with the market.

Stocks declined slightly last week despite underwhelming economic data and mixed earnings, as the market continues to be resilient.

WEEK ENDING 04/21/2023 (CUMULATIVE TOTAL RETURNS)