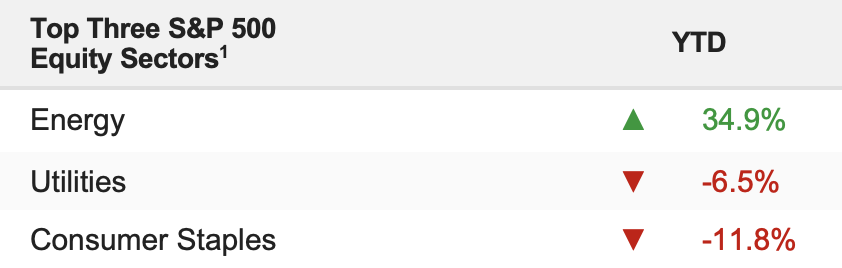

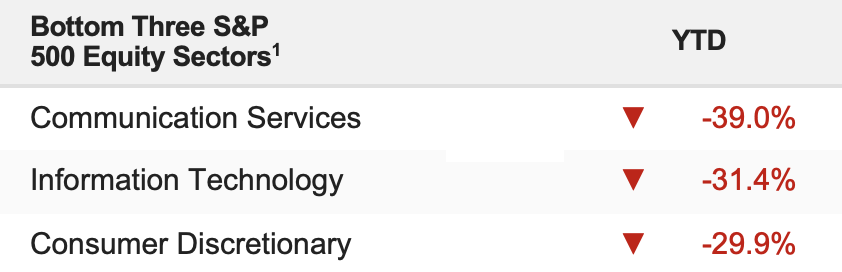

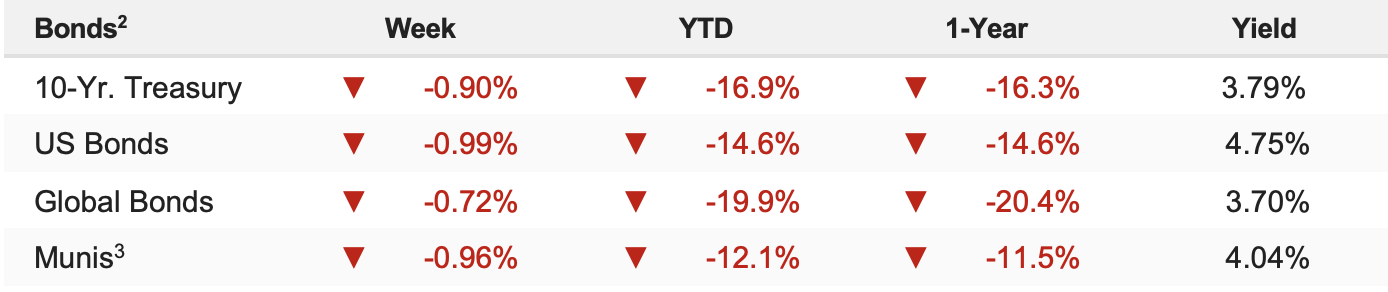

Stocks remained volatile last week as inflation worries spurred big moves in forex (currency trading) and fixed income markets while Fed rhetoric remained very hawkish. The S&P 500 fell 2.91% and is down 24.77% YTD.

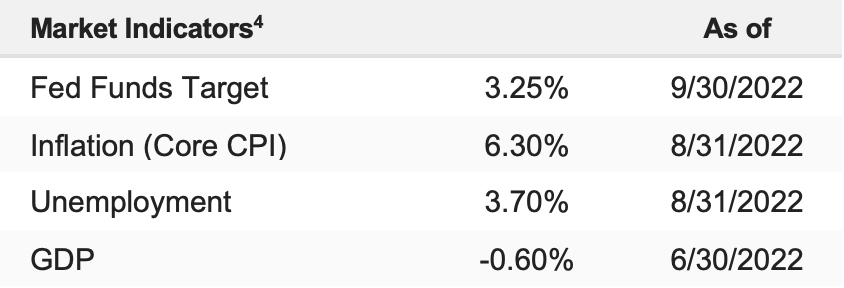

Stocks dropped to fresh 2022 lows on the final day of the third quarter, and frankly, that shouldn’t come as a surprise given the deterioration in macroeconomic conditions last week. Global macro uncertainty increased between the Truss (UK) spending plan/bond yield rise and Russia’s annexation of Ukrainian territory. Last week, earnings warnings continued to pile up, most notably CarMax (CMX) and Nike (NKE). The Fed isn’t getting any less hawkish (Brainard on Friday reiterated the Fed’s commitment to hiking rates), and inflation remains sticky (Friday’s Core PCE Price Index).

More to that point, in order for stocks to sustainably rally, they need an environment that looks something like this:

- Geopolitical stability and calm.

- Consistent and economically supportive fiscal and monetary policy.

- Solid economic growth.

- Strong margins and revenue growth.

We have none of those conditions right now.

So, for stocks to stabilize, we must have good things happen and move towards some of those conditions. Positively, that can happen relatively soon.

Some positives lurking out there that will help arrest the continued deterioration in conditions include (in order of positive impact): 1) A sharp drop in inflation metrics. This is coming, it’s just a question of when, and once it happens, the negative feedback loop on stocks will be broken. 2) Fed officials clearly signaling an end to the hiking cycle, effectively declaring the “Fed pivot.” 3) Positive earnings commentary. Yes, there have been a lot of negative pre-announcements over the past few weeks, but that’s also mostly normal for the few weeks leading up to earnings season. If companies are more positive on the outlook than is currently expected (as happened with the Q2 earnings), then that will offset growing worries that earnings expectations are about to fall sharply. 4) The global geopolitical and macroeconomic landscape gets better via Truss (UK) backing off her spending package (even reducing it) or the Russia/ Ukraine war establishing a ceasefire or practical stalemate.

The good news is that all of these positives are attainable, and with sentiment so negative all we need is one or two to help markets stabilize. As such, we continue to hold defensive long positions. This market is at new lows because we keep getting new and different bad news, but again that can stop. When positives start to occur, they can reverse a lot of this negative sentiment—and that’s not as remote a possibility as the price action implies.

For now, we have to “wait” until that good news appears and hope that self-inflicted additional policy headwinds can ease up because they are responsible for the last 300 points of decline in the S&P 500. Actual fundamentals aren’t this bad, it’s just we keep getting new headwinds introduced, and that must stop if stocks are to stabilize and eventually form a bottom.