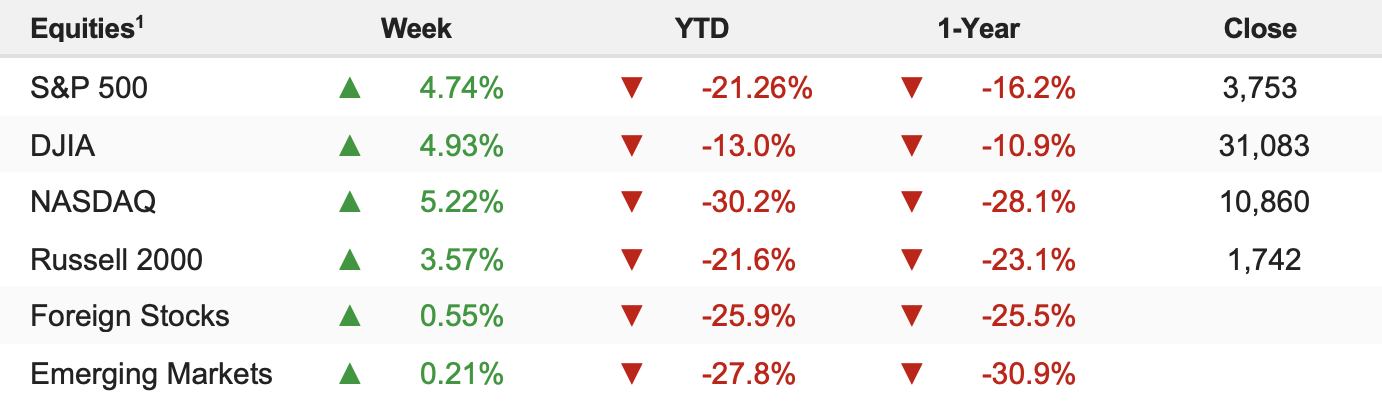

Stocks bounced solidly last week thanks to a combination of mostly good earnings and renewed hopes for peak Fed hawkishness despite more hot inflation data and lingering recession concerns. The S&P 500 jumped 4.74% on the week and is now down 21.26% YTD.

Like most people, we enjoyed Friday’s rally, and the idea the Fed hikes less than 75 bps in December could fuel a bounce towards 3,800 or 3,900 in the S&P 500. But that is not a Fed pivot.

It’s all about the “terminal rate” (we reinforce this later). If the Fed hikes 50 bps in December but keeps hiking through the first half of 2023, that’s not a Fed pivot. The Fed pivot will occur when the Fed signals it has set a definitive point to be “done” with rate hikes, and that won’t occur until inflation has started to meaningfully drop.

3 Keys to a Bottom Updated

In early May, we identified three keys to a market bottom—events that we (still) believe need to occur before we can confidently say that the bottom is “in” and we can begin to position for an eventual recovery (meaning aggressively buy). Notably, we did not change these keys to a bottom when the U.K. fiscal debacle occurred, and that’s because it was an “unforced error” we expected to be corrected, thanks to massive bond market pressure, and it was. It was an unneeded, short-term negative influence, but it didn’t change the core underlying drivers of this bear market.

Bottom line, staying focused on these keys to a bottom helped us remain skeptical that the June lows could hold (and advocate using the summer bear market rally to further brace portfolios for more volatility), and we will continue to remain focused on these “Three Keys” as they remain apt for this market. These events need to occur before we can say, with confidence, the bottom is in, the risk/reward has now skewed higher, and it’s time to take advantage of a massive long-term opportunity. We have updated the progress, or lack thereof, for these “Keys to a Bottom” below.

Key to a bottom 1

Chinese Lockdowns Ease and Growth Recovers. How we’ll know: China Covid cases drop, Chinese PMIs rise back above 50, and the yuan moves back towards (and below) 6.50 to the dollar (currently around 7.20 to the dollar).

Update: The Chinese economy has partially reopened, and activity is higher than it was in April and May. Still, economic activity remains well below “normal” levels, and the risk of more lockdowns and more disruptions remains as Chinese authorities hang onto their “Zero- Covid” policies—a reality that was reinforced rhetorically by Premier Xi at the recent Communist Party Congress and reinforced practically via recent restrictions in Shanghai. As a result, this key to a bottom has not been satisfied, as China continues to act as an anchor on and posing a risk to global economic growth.

Bottom Line: No material progress.

Key to a bottom 2

Inflation Peaks and Declines and We Get to Peak Hawkishness from the Fed. CPI, the Core PCE Price Index, and the price indices in the monthly PMIs begin to meaningfully decline. If CPI can get back down near 3%-5% towards the end of the summer (August), that will likely make the Fed back off the hawkish rhetoric, confirming “peak hawkishness” is upon us and helping to form a sustainable bottom.

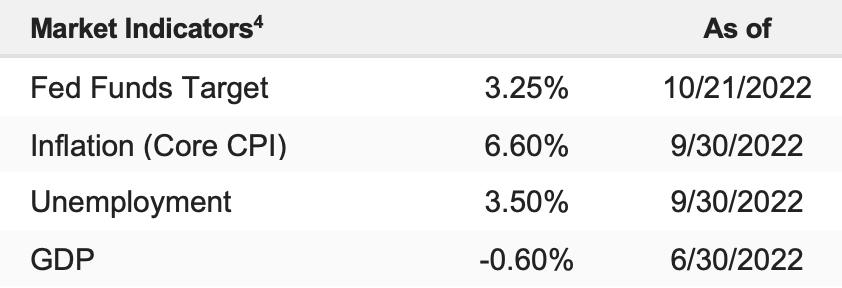

Update: Clearly, this hasn’t happened. Inflation remains stubbornly high, with CPI still above 8%, and while it’s possible it has peaked, there’s been no meaningful decline yet. On the Fed, there is an important point we all need to understand. Stocks rallied on Friday because of the WSJ article that stated the Fed may hike 50 bps in December. That’s great, and we’re happy stocks rallied. But that has nothing to do with peak hawkishness, which solely depends on the terminal fed funds rate. A peak in that rate needs to be confirmed by the Fed for peak hawkishness to be achieved. The Fed just hiking less in December can cause a short-covering rally, but it won’t satisfy peak hawkishness.

Bottom Line: Not enough progress.

Key to a bottom 3

Geopolitical Tensions Decline. How we’ll know: Oil and other commodities will drop to pre-war levels.

Update: Positively, global commodities prices have fallen as the Russia/Ukraine war has largely stalemated, but the declines in those commodities haven’t been the result of reduced geopolitical tensions. Instead, it’s been the result of the commodities markets pricing in rising chances of a global recession. Meanwhile, geopolitical tensions have actually risen with the threat of a broader conflict or a nuclear detonation rising since the summer. Commodities have declined, but geopolitical tensions remain elevated, which will remain a material headwind on the global economy.

Bottom line: No material progress.