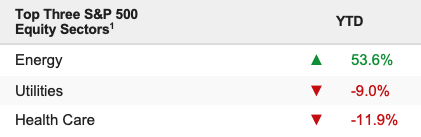

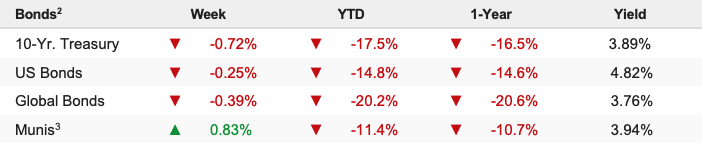

Stocks attempted to stabilize at the start of last week, but hawkish Fed rhetoric and mixed economic data that pointed to a still-resilient labor market saw stocks pull- back in the back half of the week. The S&P 500 rose 1.51% on the week but remains down 23.64% YTD.

From a technical standpoint, stocks did hang on to a gain last week and held above the 2022 lows, albeit not by much. However, that leaves the door open to a continued relief rally near term if yields continue to pull back and the dollar doesn’t resume its rally. Those have been the two biggest cross-asset headwinds for equities. Speaking of cross-asset perspectives, the most notable thing we have seen develop in recent weeks was a breakout above a long-term downtrend line in the VIX.

We mentioned the VIX has made a series of “lower highs” while stocks have repeatedly broken down to new lows so far in 2022, which is explainable by a lack of demand for hedges as institutional investors liquidate equity holdings and abandon their associated hedges. This matters because we most recently saw the very same dynamic in 2008 before the selling pressure accelerated and more than two-thirds of the ultimate bear market declines occurred into the early 2009 lows. We will flush this out in more detail this week, but we wanted to bring it to your attention as we find ourselves at yet another technical tipping point for stocks.

The Current Realities Facing Stocks (Not Good)

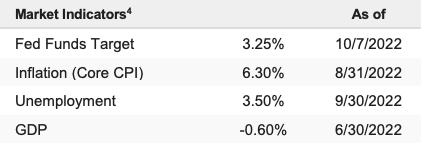

Stocks were able to log a modest rally last week but finished well off the highs. While there were some positives amidst last week’s news, the overarching reality remains that with the Fed hiking this aggressively, it’s very hard for stocks to mount a sustainable rally—and that was proven again last week.

That reality that the Fed is constantly increasing rate hike expectations is pressuring the market multiple means that, at best, stocks can muster small spikes but largely drift sideways—all the while remaining vulnerable to negative headlines. Put bluntly, as long as the Fed is this hawkish, the market can really only go two directions: Sideways or down.

It’s like if we’re in a boat with a hole in it. The hole in the boat does not mean that the boat will automatically sink (so Fed rate hikes don’t automatically mean a recession and further market decline). But we can’t even begin to get the water out, let alone get the boat back to shore until the hole is patched up (investors can’t expect higher stock or bond prices until the Fed signals it’s stopping with the rate hikes).

That’s why the Fed pivot is so important—markets can’t rally until they know this won’t constantly be a headwind. Positively, with sentiment this negative and markets down this much, the market won’t need Fed rate cuts to spark a rally. Instead, the market needs the Fed to make that pivot and essentially say, “they’re done,” because, at that point, we can look at economic data and earnings, and if either one is not as bad as feared, then this market can rally considerably.