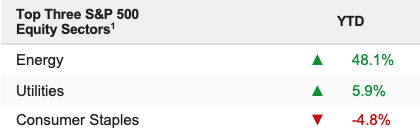

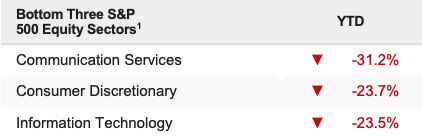

Market volatility persisted last week as the outlook for Fed policy remained increasingly hawkish following Powell’s Jackson Hole speech, while geopolitical tensions and inflation concerns remained notable headwinds on risk assets. The S&P 500 fell 3.29%, leaving the index back down by 17.66% YTD.

3 Keys to a Bottom Updated (Some Progress but Not There Yet)

In early May, we identified three keys to a market bottom—events that we believe need to occur before we can confidently say that the bottom in this market is “in,” and we can begin to position for an eventual recovery. As we now focus on the four-month, post-Labor Day sprint into year-end, we wanted to provide an update on these Three Keys to a Bottom, so we have context for the current macroeconomic environment.

Key to a bottom 1

Chinese Lockdowns Ease and Growth Recovers. How we’ll know: China COVID cases drop, Chinese PMIs rise back above 50, and the yuan moves back towards (and below) 6.50 to the dollar (currently around 6.75 to the dollar).

Update: There’s been some slight movement on China abandoning the “Zero-COVID” policy, but the Chengdu lockdown last week was a stark reminder that the Chinese economy is not functioning at full capacity and that more lockdown risks remain. More specifically, Chinese PMIs are not back above 50, and the dollar/yuan remains close to 7.00 (a long way from the 6.50 level that implies “normal” exchange between the two currencies).

Bottom Line: No material progress. The Chinese economy has reopened, and activity is higher than in April and May. However, economic activity remains well below “normal” levels, and the risk of more lockdowns and more disruptions remains. As a result, this key to a bottom has not been satisfied, as China continues to pose a risk to global economic growth.

Key to a bottom 2

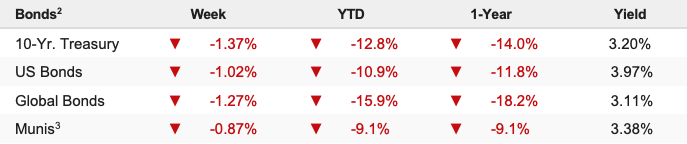

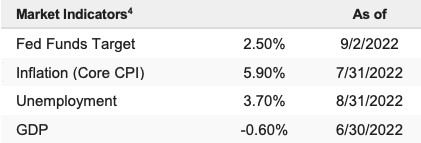

Inflation Peaks and Declines and the Fed Eases Off the Hawkish Rhetoric. CPI, the Core PCE Price Index, and the price indices in the monthly PMIs begin to decline meaningfully. If CPI can get back down near 3%-5% towards the end of the summer (August), that will likely make the Fed back off the hawkish rhetoric, confirming “peak hawkishness” is upon us and helping to form a sustainable bottom.

Update: There’s been real progress here as we’ve seen both CPI and the PMI Price indices start to fall quickly, and we believe it’s safe to say we’ve hit “peak inflation.” But we have not yet hit peak hawkishness. Markets thought we had reached peak hawkishness, and that’s why the Fed pivot idea pushed stocks higher. However, Powell destroyed that idea two weeks ago. So, it’s still not evident 1) When the Fed will stop hiking rates or 2) How quickly they’ll begin to ease policy.

Bottom Line: Some progress. Inflation has peaked, but it’s unclear if the “terminal” fed funds rate (the level at which they stop hiking) is above or below 4.0%. Until the Fed clearly signals that peak hawkishness has been reached, the prospect of more rate hikes will remain a threat to the markets.

Key to a bottom 3

Geopolitical Tensions Decline. How we’ll know: Oil and other commodities will drop to pre-war levels.

Update: Positively, global commodities prices have fallen as the Russia/Ukraine war has largely stalemated, but the declines in those commodities haven’t been the result of reduced geopolitical tensions. Instead, it’s been the result of the commodities markets pricing in rising chances of a global recession. Meanwhile, geopolitical tensions haven’t risen, but they haven’t receded, either.

Bottom line: No material progress. Commodities have declined, but geopolitical tensions remain elevated, and that will remain a material headwind on the global economy.

Stocks rallied from the June lows primarily thanks to the market believing that 1) Peak inflation and 2) Peak hawkishness (the Fed pivot) were imminent. But it turned out that only peak inflation occurred, and the market pricing in that reality is why stocks have fallen over the past week. Positively, there has been progress towards accomplishing the Three Keys to a Bottom, and as a result, while stocks may test the June lows, it’s unlikely we see a material break of those levels unless economic growth rolls over or inflation flares up again. That said, we cannot say that the bottom is “in” yet because these three keys remain outstanding.