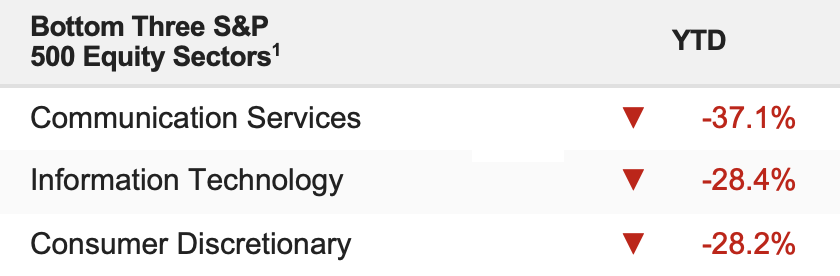

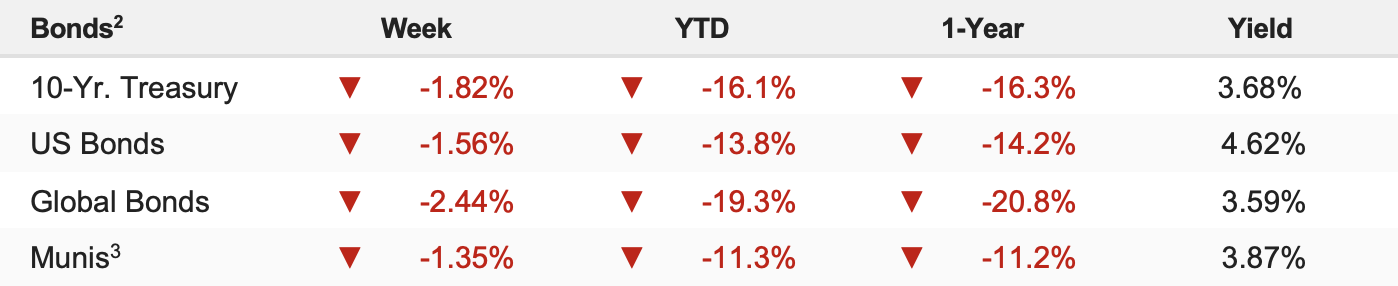

Equity markets remained volatile last week as a hawkish Fed sent Treasury yields and the dollar sharply higher, which weighed heavily on stocks. The S&P 500 sank 4.65% on the week and is down 22.51% YTD.

How Bad Can It Get and What Makes It Stop?

The S&P 500 plunged on Friday and finished the session near YTD lows, as a combination of negative momentum following the Fed’s hawkish rate decision combined with a violent macroeconomic reaction to the UK’s ill-advised stimulus plan, as UK 10-year GILT yields spiked more than 30 bps on Friday while the pound fell 3%. Simply put, those are enormous moves for typically well-anchored and widely owned assets—we are not talking about Greek bonds or the Turkish lira—we’re talking about the pound and GILTS. That further unnerved investors and demonstrated that previous solutions to market stress (stimulus, either from the government or central bank) wouldn’t work this time (this has been known for a while, but it was put on display Friday).

Given stocks are just above fresh YTD lows, we wanted to cover what we believe are the two most important questions regarding this market: 1) How Bad Can It Get and 2) What Makes It Stop?

Question 1: How Bad Can It Get?

Early this month, in the September Market Multiple Table, we outlined the “Gets Worse If” scenario and the first two points were:

- “The Fed hints the terminal rate will be substantially above 4%.”

- “Prices stabilize in September, and hope shrinks for a quick decline in prices.”

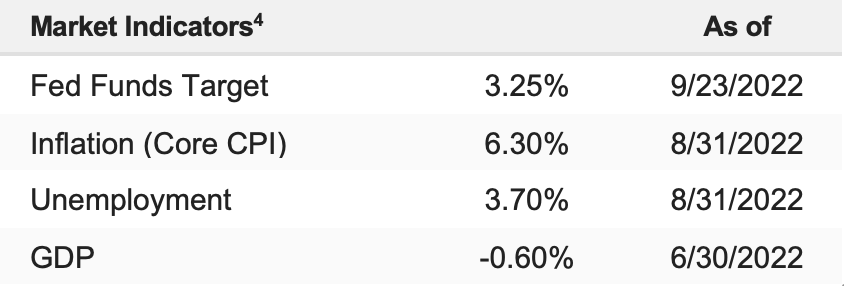

Well, the Fed didn’t hint at a terminal rate substantially above 4%; they put it in writing. Meanwhile, CPI didn’t fall. So clearly, the outlook for markets has deteriorated as the two major triggers for our “Gets Worse If” scenario have been elected. In the MMT, we cited a “worst-case” scenario for the S&P 500 of 3,300, which was the product of a recession multiple (15X) and $220 2023 EPS (nearly a 10% drop from the current expectation of $240). We remain broadly comfortable with that level as a fundamental worst-case scenario, as it factors in a recession and minimal yoy earnings growth.

Yes, there are numerous firms and research houses that have downside targets lower (3,150, 3,000, below 3,000). But to get to those levels, one would have to price in an extremely substantial economic slowdown and a multiple below 15X (which can happen but is rare), and intense earnings destruction.

Using history as a guide, from 1990 through 2006 (before QE, 0% rates, etc.), the average annual earnings growth rate of the S&P 500 was about 11%. If we use 2019 as our benchmark, the “natural” 2023 S&P 500 EPS would be $211/share. In that instance, and even pressuring the multiple further, to say, 14X, that means a worst-case S&P 500 scenario would be 14*$211 = 2,954. So, if we think about how bad it could get, we’d say in a truly full negative scenario, somewhere between 2,954- 3,330.

To be clear, we’re not saying stocks will get there, as a lot more would have to go wrong for that to happen. But between 2,954-3,330, we’d be well-below historical norms on 1) valuation and 2) earnings growth, and we know we would be strongly advocating for anyone with a time horizon over a year to be aggressively buying equities in that range.

Question 2: What Makes It Stop?

There are three events that would help stop the market’s near-term declines.

- A soft CPI number. Next release Oct. 13. If CPI drops moderately, that will signal disinflation is quickly taking hold, and we could easily see a 5% (or more) rally in this market because it’d call into question the Fed’s dots and likely result in a decline in the terminal rate in the coming months.

- Better-than-expected earnings. Q3 earnings season begins October 14. Earnings concerns are pressuring stocks. If companies come out, like in Q2, and basically say business is holding up fine, that will go a long way to easing concerns about an imminent collapse in corporate earnings.

- Dovish Fed speak. As I showed in last Friday’s report, the Fed has a consistent history of “blinking” on rate hikes when the economy comes under stress. If Fed rhetoric turns towards a slowing economy and building economic risks, then expectations for the terminal rate may begin to drift lower, and that would likely result in a big relief rally.