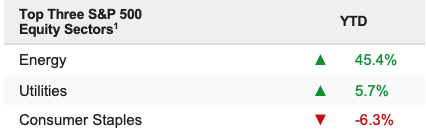

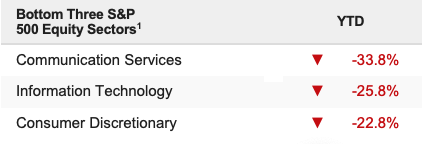

Volatility surged last week with the major indices falling to multi-month lows on the back of hotter-than-expected inflation data into a sizeable quadruple witching options expiration on Friday. The S&P 500 dropped 4.77% on the week and is now down 18.73% YTD.

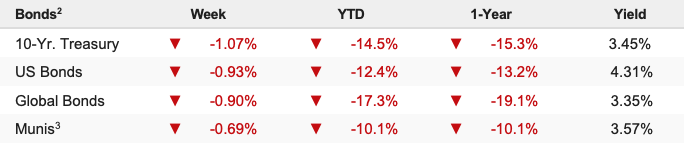

Market Set Up into the Fed Decision Stocks dropped sharply last week for multiple reasons, including the lack of a meaningful decline in the August CPI (meaning inflation is proving sticky for now), an increase in the market’s expectations of the terminal fed funds rate (to 4.25%-4.50% from the previous 3.875%-4.125%), and several higher-profile earnings warnings.

Those forces combined to push the S&P 500 through the early September lows, and the index closed at the lowest level since early July. Given last week’s news, that should not surprise us.

Here’s why:

The rally from the June spike lows was driven initially by the hope that inflation was peaking. That hope for an inflation peak then met with much-better-than-feared Q2 earnings (which began to be released in early July), and the S&P 500 enjoyed a solid bounce off the June lows.

In August, CPI and other inflation metrics declined, validating the idea that inflation had peaked. The peak in inflation and better-than-feared corporate earnings were two legitimate positives that justified the rally off the June lows.

Then markets (and investors) got ahead of themselves. In part due to the perceptions of a slightly dovish tone at the July FOMC meeting, investors pushed stocks higher on the idea of a looming “Fed pivot” in which the Fed would signal it had reached “Peak Hawkishness.” That hope, combined with typical chasing by investors and traders, powered the S&P 500 to 4,300, despite the fact that there was virtually no actual evidence to back up this Fed pivot idea. And when Powell dismissed the idea at Jackson Hole, the S&P 500 gave back more than half of the bounce off the June lows.

Not to be deterred, however, and in part due to a sharp drop in the price indices of the regional and national manufacturing and service sector surveys (Empire, Philly, ISM Manufacturing and Services PMI), markets convinced themselves that a sharp deceleration in inflation was now upon us and that while the Fed pivot may still be a few months off, the impending steep drop in inflation would help make the Fed less hawkish.

Like the Fed pivot idea, the “rapid disinflation” idea, which was only ever supported by anecdotal evidence, was proved wrong last week not just by CPI but by the fact that the University of Michigan’s five-year inflation expectations rose to 3.0% from 2.9%.

With Fed pivot and disinflation hopes dashed, the S&P 500 went right back to the September lows at 3,900, and then FedEx earnings hit. To be clear, the FedEx numbers are not an indictment of the upcoming earnings season, but many analysts (including me) were very skeptical of the idea that 2023 S&P 500 earnings would be able to hold at $240/share, which is where they were after Q2 earnings, and the cumulative earnings warnings last week, of which FDX was just the highest profile, reminded markets that there’s really only one directional risk to the $240 2023 EPS expectation, and that’s lower.

So, did the outlook for stocks get that much worse this past week? No, it didn’t!

At the September Market Multiple Table, we believed the “fair value” of the S&P 500 to be between 3,680-3,910, with a midpoint of 3,795. Nothing has occurred that would make us change that estimation. Instead, the market has been forced to confront the reality that, while there have been some positives since the June lows (peak in inflation, more resilient corporate earnings), the major problems with this market, Fed rate hikes and very high inflation, have not been fixed. As such, we must be skeptical of any sizeable rallies that come without legitimate improvement in those two issues.

Meanwhile, the S&P 500 is absolutely not pricing in a material economic slowdown. If there is a material eco- nomic slowdown or contraction, and earnings aren’t as resilient as investors hoped in Q2, the S&P 500 could lose another 10% easily and still not be a compelling value.

Positively, that’s not a foregone conclusion. The economy has been more resilient than expected. Earnings have been more resilient than expected. Inflation has peaked, and certain indicators are showing a material drop in inflation pressures (the Empire and Philly price indices), but while that’s enough to warrant stocks trading above the June lows, it’s not enough progress to validate the S&P 500 above 4,000.