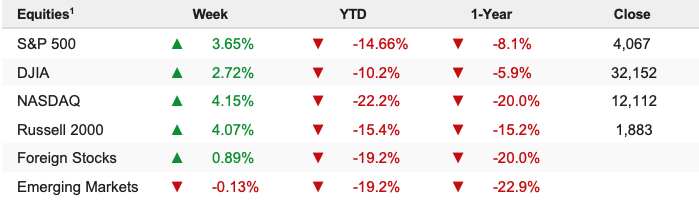

Stocks fell to new lows early last week amid still-aggressive monetary policy expectations and global economic worries before some slightly less-hawkish Fed chatter later in the week sparked a relief rally. The S&P 500 gained 3.65% on the week and is down 14.66% YTD.

Why Stocks Rallied Last Week (And Is It Sustainable?)

Stocks enjoyed a solid rally last week, and frankly, that makes sense as multiple pieces of potentially good news hit the tape, combined with short-term oversold conditions and negative sentiment to spark a solid rally.

The following events spurred the rally (in order of importance).

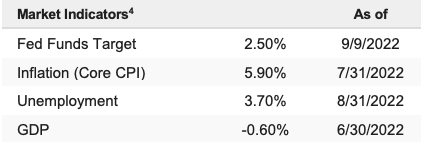

First, there was more evidence of a decline in inflation. The Chinese CPI and PPI reports on Friday only reinforced that we’ve likely seen peak inflation globally. Additionally, there are some hints that inflation may decelerate somewhat quickly, although it’s still far too early to declare that. Nonetheless, the hints of that possibility helped stocks rally.

Second, major global central banks are hiking rates, but an end is starting to come into sight for the rate hike campaigns. The Reserve Bank of Australia signaled that while rate hikes will continue, they’ll get smaller. That’s not an outright positive, but it reflects the fact that, at this point, we’re likely closer to the end of the global rate hike cycle than we are at the beginning (and the Fed will likely join this chorus, although that’s not a less- hawkish pivot).

Third, the dollar may have peaked. The exploding U.S. dollar is a material headwind on the global economy; frankly, the higher it goes, the greater the chance there’s some sort of global dollar funding crisis. The ECB hiking 75 bps and signaling more hikes are coming, combined with rising hopes for a decline in inflation, pressured the dollar Friday, and if the dollar rally has ended, that removes risk from markets.

Finally, the Fed wasn’t any more hawkish than expected this past week (it wasn’t dovish either, but we’ll take it), and U.S. economic data appears solid, which reduces the chances of an imminent recession and increases the chances of an economic soft landing.

So, do these positives mean the outlook for stocks has improved significantly?

No, absolutely not.

As the Market Multiple Table demonstrated earlier last week, around 3,900-ish, the S&P 500 is fairly valued for the current reality. And if we combine a short-term oversold condition with suddenly negative sentiment, last week’s slightly optimistic headlines caused a decent rally.

However, don’t confuse last week’s optimism with the actual positive resolution of important events. Yes, inflation’s peaked and is receding, but we don’t know how quickly that goes. Yes, the Fed didn’t get any more hawkish, and the pace of rate hikes will slow (again it has to), but we still don’t know if the “terminal rate” will be slightly below or meaningfully above 4.0%. Yes, the dollar is looking like it may have peaked, but we’ve seen several of these head fakes in 2022, and for the dollar to stop being a headwind on U.S. corporate earnings and the global economy, we need to see the Dollar Index drop back towards par (100). Finally, yes, economic growth is holding in well, but the 10s-2s treasury spread is still inverted, and we have yet to feel the economic impact of these rate hikes, so it’s much too early to get optimistic about a “soft landing.”