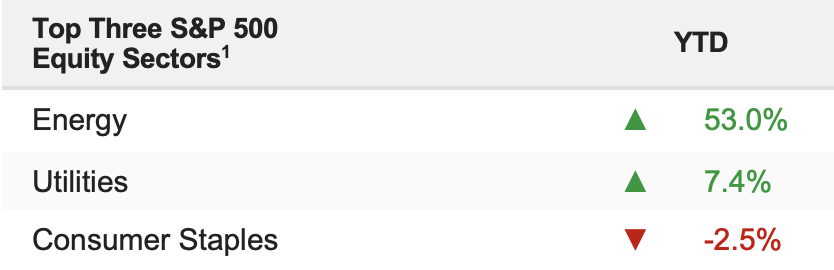

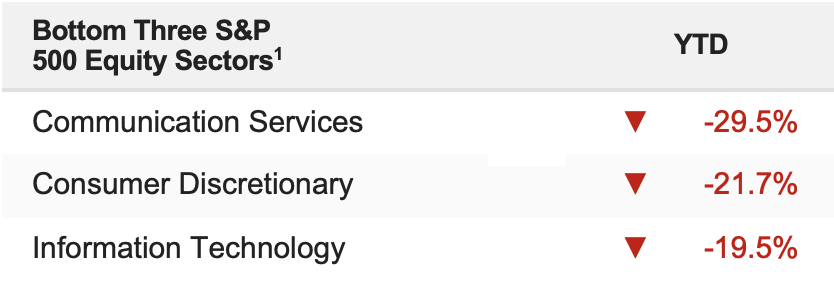

Stocks were volatile last week as markets repriced a more hawkish Fed, which sent yields and the dollar higher while stocks plunged. The S&P 500 fell 4.04% on the week and is now down 14.87% YTD.

Does Powell say rates may need to be “restrictive?”

Yes, he did. Early in the speech, he said rates would need to be raised into restrictive territory to slow growth and inflation.

Does Powell highlight the risk of overtightening policy?

No, he did not. He didn’t even mention the risk of over-tightening, and that contradicts the idea from the FOMC minutes that there’s a growing movement in the Fed that’s worried about overtightening.

Does Powell substantially highlight the progress on inflation?

No, he did not. In fact, he downplayed the one month of progress on price increases, implying the Fed is a very long way from declaring the war on inflation over.

Does Powell again explicitly say that future rate hikes will be smaller than previous ones?

He did say that, at some point, rate hikes would become smaller. However, he immediately hedged that by also stating that rates may need to stay higher for longer to bring down inflation.

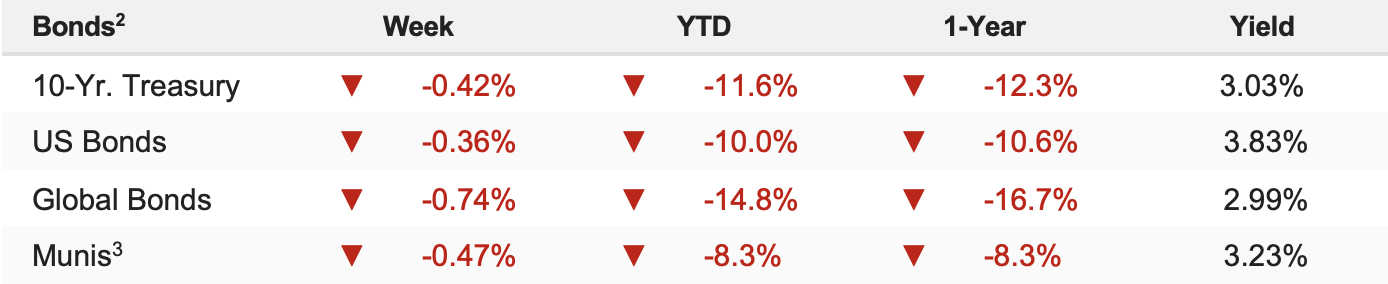

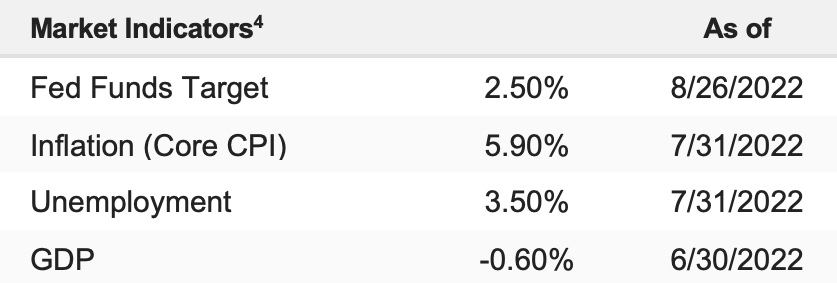

Powell didn’t imply the Fed is going to hike rates any more than expected, and it remains a 50/50 toss-up whether the September rate hike in 50 bps or 75 bps. Additionally, year-end and terminal fed funds rate expectations did not change materially (markets still expect fed funds around 3.5% at year-end and around 3.75% terminal rate). So in that regard, Powell was not hawkish.

But Powell did very directly and explicitly push back against the idea of an imminent less-hawkish Fed pivot. Despite virtually every Fed speaker saying the same thing for the past two weeks, the market finally listened, and we saw some of the Fed pivot rally of the past few weeks given back on Friday.

Put simply, it means that we can’t say we have reached “Peak Hawkishness” from the Fed, and as such, our first “Key to a Bottom” has not yet been satisfied. So, while we think it’d take a surge in fears of a material recession to send the S&P 500 back towards 3,600, the bottom line is that this market has lost one of the main drivers of the rally—the expected Fed pivot.

So, we should expect some continued giveback of this recent rally and an outright pullback of 5%-10% if 1) Economic data rolls over hard, raising stagflation risks, or 2) Corporate earnings expectations begin to get revised materially lower.