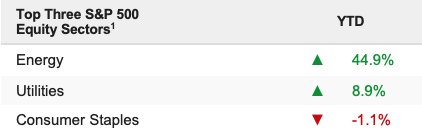

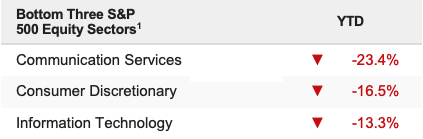

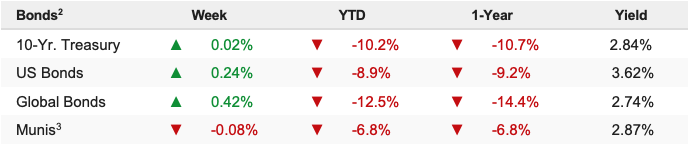

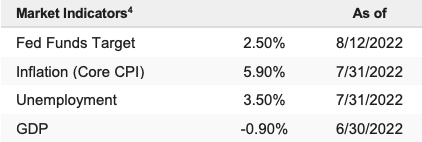

Stocks extended the recent rally and climbed to three-month highs after CPI and PPI likely confirmed a peak in inflation. The S&P 500 rose 3.26% on the week and is down 10.20% YTD.

In May, we listed three keys to a market bottom, and the first (and most important) key was that we achieve peak inflation and peak hawkishness from the Fed, and after last week’s CPI data, it’s worth examining whether that key to the bottom has been satisfied.

In short, no, it has not.

Yes, inflation has likely peaked, which is a good thing (fully reflected in the S&P 500 trading above 4,200). However, we are not yet at peak hawkishness from the Fed. Sure, there’s reason to believe that peak hawkishness may occur soon. Inflation should start to decline, and growth should continue to slow. And the Fed may well reduce the size of rate hikes going forward, from 75 bps to 50 bps in September and 25 bps in November and/or December.

However, reducing the intensity of rate hikes isn’t peak hawkishness. The Fed strongly hinting that fed funds won’t rise above the estimated 3.50% at all is peak hawkishness, and it’s not clear we are there yet. For the Fed to declare the rate hike cycle is ending, it’s got to be very confident that:

- The labor market will return to a better state of balance (not happening yet).

- That inflation will gradually return to their 2% target (not happening yet).

- That inflation expectations will remain well anchored near 2% (not happening yet).

Positively, this can become much more likely between now and the September FOMC meeting, where the Fed could signal that peak hawkishness has occurred. During that time, we could see JOLTS (job openings) fall towards a more historically average 7 million, weekly jobless claims should rise towards, and perhaps through, 300k, and the August jobs report will hopefully show a cooling of the labor market.

Additionally, we’ll have a lot more price data, e.g., August and September Empire and Philly Fed price indices, national ISM PMI price indices, and the August CPI report (out in early September). If those numbers confirm inflation is quickly receding, then peak hawkishness becomes more likely. If longer-run inflation expectations don’t rise above 3%, that’ll confirm that inflation isn’t becoming a longer-term structural problem. Suppose all that happens in the coming weeks and economic growth stays resilient. In that case, we will not only be at peak hawkishness, but we’ll also be able to, for the first time, talk about an economic soft landing as more than just a hopeful event (which it still is despite the market’s sudden confidence it’s going to happen).

Before we get too excited about that outcome, remember that these are keys to a bottom, meaning we can confidently invest knowing the bottom in stocks is in and downside risk is limited. These are not keys to a return to new highs.

To get near the old highs, from a valuation standpoint, we’ve got to be talking about a 19X-20X multiple on $240 2023 S&P 500 earnings. That’s not impossible, but it does require an environment that’s characterized by:

- Sharply decelerating inflation that’s readily approaching 2%-3%.

- A total economic soft landing where growth never really slows (meaning 10s-2s is completely wrong).

- A Fed that flips from tightening policy to actively stimulating policy (meaning aggressive rate cuts).

Again, we’re not saying that’s impossible. However, that does seem like a long way from the current state of things, and it essentially involves nothing going wrong (not sticky inflation, not a global recession, not a geopolitical surprise, not any earnings degradation, etc.).