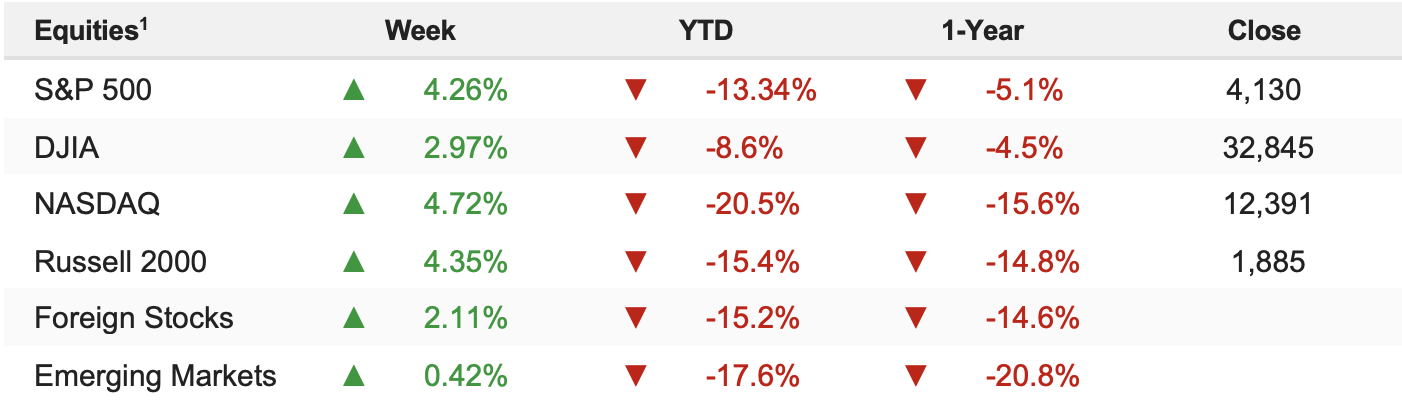

Stocks roared higher last week as the combination of mostly solid tech earnings and less-hawkish Fed policy expectations offset downbeat economic data. The S&P 500 rallied a robust 4.26% on the week, capping off the best monthly performance since November 2020. However, the index remains down 13.34% YTD.

Stocks staged an impressive rally last week and the S&P 500 broke above resistance at 4,100 as the multi-week rally from the June lows continued. There were two legitimate positives last week that fueled the gains.

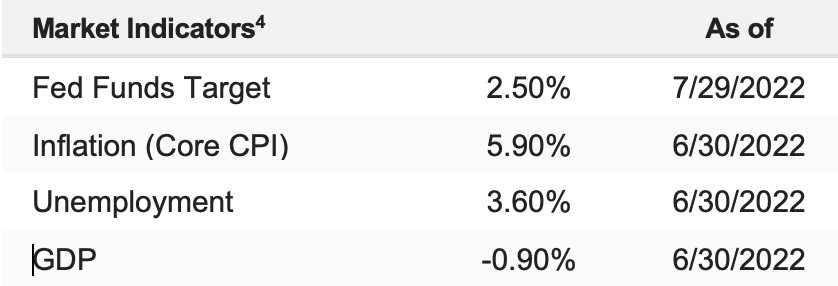

First, the Fed wasn’t more hawkish than expected in its FOMC decision or Powell’s press conference, and given the market badly wants to believe a less-hawkish Fed pivot is coming, that lack of overt hawkishness helped fuel that belief (this was the primary driver of the rally last week).

Second, the earnings season was not as bad as feared. With most of the largest S&P 500 companies already reporting, it looks like 2023 expected S&P 500 EPS will stay in the $230-$240 range for now. That’s obviously a reduction from the previous $245-$250 consensus, but it’s a lot better than the worst fears of $210-ish (or lower).

But while those two events were positive in so much as they weren’t as bad as feared, this market has come a long way in a short time on not a lot of actual good news. Specifically, the S&P 500 has rallied more than 10% from the June spike lows, and while part of that was a natural bounce back from the violent declines in June, much of this rally has been fueled by the market’s increasingly intense belief that we are on the precipice of peak inflation and peak hawkishness from the Fed.

Indeed, peak inflation/peak hawkishness comprise one of our “Keys to a Bottom,” and when they occur that will erase a powerful headwind on stocks. And with the S&P 500 around 3,700 (or lower) it’s fair to say markets were extremely pessimistic about the outlook for inflation and Fed tightening. But frankly, we’d feel a lot better about this rally if it were driven by more actual improvement in underlying inflation metrics and Fed commentary and not just the increasing hope that inflation will turn starting next week because commodities are down, and retailers are slashing prices to move inventory.

Yes, commodities are declining. Yes, growth is slowing. To be clear, I hope the market is right and that this near-term peak and drop in inflation results in the Fed getting less hawkish in the next month or two.

Based on facts—namely the still tight labor market, the moderate decline in commodities (but not collapse), general continued economic strength, and the fact that CPI is at 9% YoY, a very, very long way from anywhere the Fed could “pause,” we think this rally is ahead of itself (perhaps by as much as 5%-10% if the Aug. 10 CPI doesn’t show a peak and hint at a sharp drop in inflation pressures).

On a valuation basis, at 4,130 the S&P 500 is now trading at 17.6X 2023 earnings of $235/share—hardly a low multiple for an economy that will have to digest nearly 300 bps of rate hikes in just over six months!