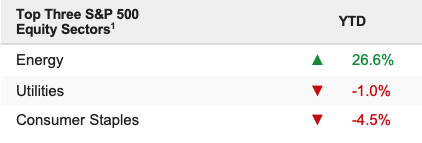

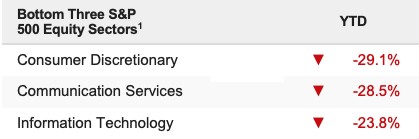

Stocks declined early in the week amid growth concerns and hot inflation data, but the market was able to stabilize into the weekend thanks to less-hawkish Fed speak. The S&P 500 dipped 0.93% on the week and is now down 18.95% YTD.

In early May, we identified three events that need to happen before we can confidently say a bottom is in for stocks. Given the latest inflation data and COVID developments in China, we wanted to update the status of our “Three Keys to a Bottom.”

Three Keys to a Bottom Updated

Key to a bottom 1

Chinese Lockdowns Ease and Growth Recovers. How we’ll know: China COVID cases drop, Chinese PMIs rise back above 50, and the yuan moves back towards (and below) 6.50 to the dollar (currently around 6.75 to the dollar).

Update: The Chinese economy has largely reopened, but this week’s shutdown in Macau and mass testing in Shanghai and other regions show that “Zero COVID” remains partially in effect, and as a result, the threat of lockdowns will continue to weigh on Chinese stocks and the outlook for the global economy.

More specifically, the June Chinese manufacturing PMI did rise above 50, although barely to 50.2, and we’ll want to see another month or two above 50 before confidently believing that Chinese economic growth is sustainable. Meanwhile, the yuan remains near 6.75 and has not traded close to the 6.50 level, where it was trading before the lockdowns started in April.

Bottom Line: Lockdowns have been eased compared to April/May, but the threat of new lockdowns clearly remains, and the Chinese economy is still not close to “typical” levels of growth, and as a result, it’s still a drag on global growth.

Key to a bottom 2

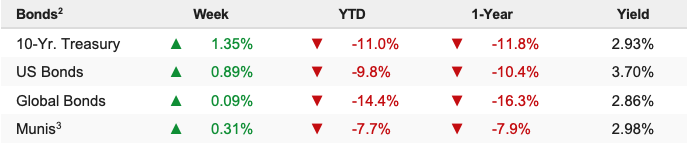

Inflation Peaks and Declines and the Fed Eases Off the Hawkish Rhetoric. CPI, the Core PCE Price Index, and the price indices in the monthly PMIs begin to decline meaningfully. If CPI can get back down near 3%-5% towards the end of the summer (August), that will likely make the Fed back off the hawkish rhetoric, confirming “Peak Hawkishness” is upon us and helping to form a sustainable bottom.

Update: We’re not close on this yet. The June CPI printed above 9%, and it’s essentially a “toss-up” as to whether we get a 75-bps hike or a 100-bps hike. Yes, there are some hints of deflation in the future, specifically, the University of Michigan’s five-year inflation expectations declining to 2.8%, continued (small) drops in core CPI and core PPI, and a moderate drop in price indices in the Empire Manufacturing survey. However, none of those are enough to convince markets that 1) Inflation has peaked or 2) Fed hawkishness has peaked.

Bottom Line: Until we get clear evidence (via headline CPI) of a peak in inflation and peak Fed hawkishness, this market will have a hard time sustaining any rally, and a re-test of the June lows can’t be ruled out if earnings disappoint over the next few weeks or economic data points roll over hard.

Key to a bottom 3

Geopolitical Tensions Decline. How we’ll know: Oil and other commodities will drop to pre-war levels.

Update: Certain commodities like wheat and corn have declined to pre-invasion levels, as markets are hopeful that grain shipments from Ukraine will start again soon. But energy commodities, despite large drops, remain above pre-invasion levels (oil and natural gas). Additionally, the drops have been driven by fears of a global recession crimping demand and a lack of export capacity in the U.S. (for natural gas), not on some geopolitical improvement.

Bottom line: While off the highs, commodity prices in general remain elevated, and that’s a continued headwind on global growth.