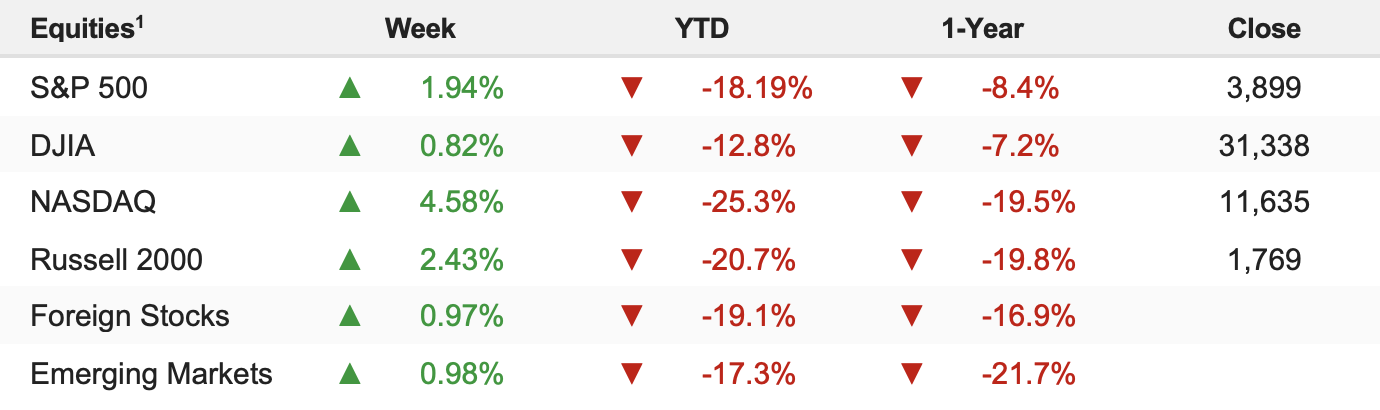

Stocks continued to stabilize last week as lingering recession fears were offset by rising optimism that the Fed has reached peak hawkishness and a “soft landing” may be possible. The S&P 500 rallied 1.94% on the week and is now down 18.19% YTD.

Current Situation

First, 2023 earnings expectations have declined sharply, thanks to a growing number of companies cutting guidance. At the start of 2022, the consensus 2023 S&P 500 EPS was $250. We thought that was too optimistic, so we penciled in $240. Well, now expectations are declining to somewhere between $220- $230 with downside risks.

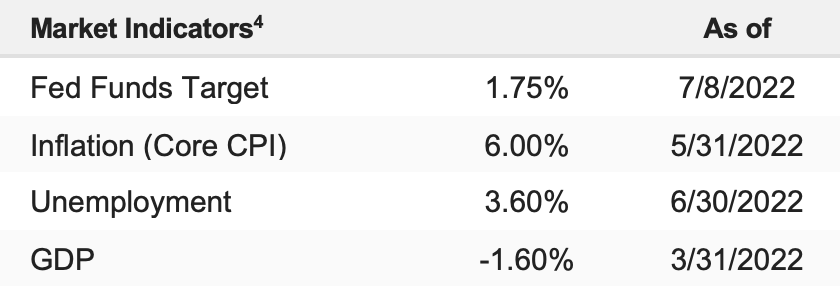

Second, the two most significant influences on the markets right now, inflation and Fed rate hikes, got worse in June via the 8.6% CPI report and the 75-basis-point rate hike.

Third, economic growth is rolling over, which means we had to drop the multiple range for the market because even if we avoid a recession, economic growth will stall—it’s just a question of how soon and how bad it gets.

Finally, COVID-19 cases declined in China, and the economy has reopened, but “Zero COVID” remains the policy, so investors are constantly operating under the threat of a lockdown.

While the spike lows of June at 3,636 were likely a bit too negative, this recent bounce in stocks isn’t being driven by anything fundamental— and that’s why we are skeptical. Instead, this bounce, like the one in March and May, is driven by the idea that rates may have peaked, inflation may have peaked, and Fed hawkishness may have peaked. For the current levels of the S&P 500 to be fundamentally supported, we’ll need some proof that’s happening, and if we don’t get that proof, don’t be surprised if we see another 5%-10% drop in the S&P 500.

Things Get Better If:

- CPI declines from the 8.6% June reading.

- The Fed hikes 50 bps and opens the door to a pause late in 2022.

- China distances itself from “Zero COVID.”

- Russia/Ukraine has a ceasefire, and economic growth slowly moderates but doesn’t collapse.

Things Get Worse If:

- July CPI rises above the June reading.

- The Fed hikes 75 bps in July and threatens more to come.

- China locks down again.

- Economic growth collapses, increasing the chances of a material contraction.