After a few weeks of markets attempting to stabilize, volatility picked up again thanks to more hot inflation data, a hawkish ECB, and increasing concerns about global growth. The S&P 500 sank 5.05% on the week and is now down 18.16% YTD.

The University of Michigan’s Consumer Sentiment fell to a record low of 50.2 vs. (E) 59.0, while 5 -year inflation expectations rose to 3.3% from 3.0% in May (investors were looking for a decline). That led to a resurgence in stagflation fears, and the S&P 500 fell sharply back towards the 2022 lows. Stocks attempted to mount a rally in late trading Friday, but the market rolled over and the S&P 500 came within a fraction of closing at a new 2022 low.

A month ago, we identified three events that need to happen before we can confidently say a bottom is in for stocks. There was some progress towards two of those “keys” over the past several weeks, but we saw part of that progress undone over the past week, and it’s not surprising that stocks dropped sharply as a result.

Key to a bottom 1

Chinese Lockdowns Ease and Growth Recovers. How we’ll know: China Covid cases drop, Chinese PMIs rise back above 50, and the Yuan moves back towards (and below) 6.50 to the dollar (currently around 6.75 to the dollar).

Update: On Thursday, Chinese authorities reinstituted partial lockdowns in Beijing and Shanghai, and on Friday, authorities announced there’d be mass testing in Shanghai. Neither event by itself is that bad (it’s true that the Chinese economy is reopening, and activity is better than it was a month ago.) But the point is that China is not abandoning its zero-Covid policy. As a result, the market must continue to consider the possibility that new lockdowns could be enacted at any time. So, while that likely won’t prevent the Chinese economy from coming back “online,” the risk of new lockdowns will remain, and that’s an issue.

Bottom Line: The Chinese economy has partially reopened and activity is better than it was a month ago. However, we’re still on a very slow road back to “normal” activity from the world’s second-largest economy. A partially operating Chinese economy with the constant threat of new lockdowns is not enough to sustain a rally.

Key to a bottom 2

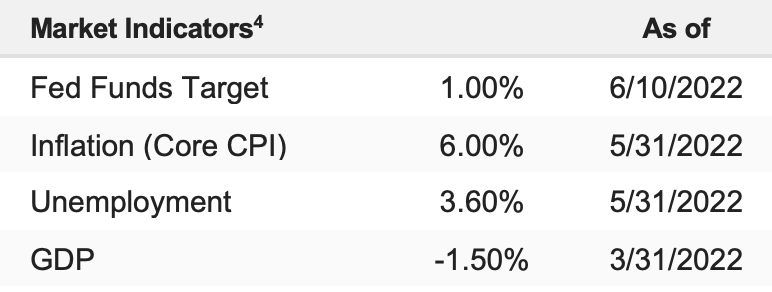

Inflation Peaks and Declines and the Fed Eases Off the Hawkish Rhetoric. CPI, the Core PCE Price Index and the price indices in the monthly PMIs begin to meaningfully decline. If CPI can get back down near 3%-5% towards the end of the summer (August), that will likely make the Fed back off the hawkish rhetoric, confirming “Peak Hawkishness” is upon us and helping to form a sustainable bottom.

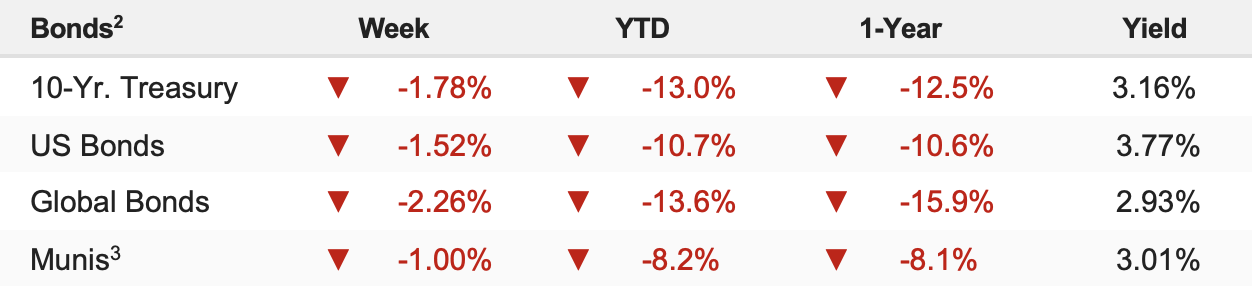

Update: Friday’s CPI essentially reversed the month of progress and hope on inflation and the future Fed rate hikes. CPI rose in May and signaled we have not yet hit peak inflation, while fed fund futures now are showing year-end fed funds at highs for the year, signaling we have not yet hit peak hawkishness.

Bottom Line: Friday’s CPI wasn’t quite as bad as the headline implied (core CPI is declining, and outside of oil and food, we are seeing moderating inflation pressures), but in this market that nuance doesn’t matter, as we saw on Friday. At this point, any hope of a pause in Fed rate hikes between now and year-end is essentially nil. That doesn’t mean one won’t happen (things can change quickly), but for now, that’s not a base case and we rightly saw those “Fed pause” driven gains of the past two weeks given back on Friday.

Key to a bottom 3

Geopolitical Tensions Decline. How we’ll know: Oil and other commodities will drop to pre-war levels.

Update: There’s been no material progress toward a ceasefire in Ukraine. However, in the past few weeks, Russia has taken much of the Donbas and may be getting to a point where they search out some sort of ceasefire and fully annex the seized land. Obviously, this has been an epic tragedy from a human standpoint, but from a market standpoint, it just wants the fighting to end. If Russia essentially accomplishes enough to declare “victory” and comes to the peace table, the markets will embrace that result. For now, commodities (especially oil and wheat) remain elevated and nowhere near pre-war levels.

Bottom line: No material progress.

Finally, stocks rallied off the May 20 lows thanks to two factors: Chinese economic reopening and a potential peak in inflation/peak Fed hawkishness. Both of those factors went backward last week, which is why we saw most of those gains from May 20 given back. Looking forward, the outlook for stocks isn’t worse than it was on May 20. China is reopening, and there is still evidence that inflation is peaking (at least on core, so looking past energy and food). So, momentum could carry the S&P 500 to new lows, but fundamentals don’t warrant a major drop in stocks absent a much-more- hawkish-than-expected Fed this week.