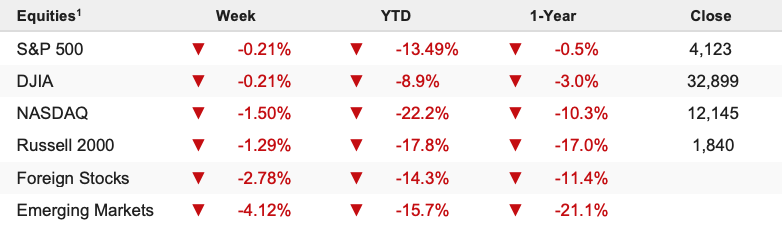

It was another rollercoaster ride in the markets last week as stocks rallied big in the wake of the FOMC meeting only to give all those gains back into the weekend as hawkish policy concerns continued to linger. The S&P 500 dipped 0.21% on the week and is down 13.49% YTD.

Market volatility increased last week as stocks gyrated wildly from Wednesday to Friday, but those moves weren’t driven by fundamentals (the outlook didn’t change much) and, instead, it’s technical and emotions (fear/greed) that are driving the markets on an intraday basis and we should all prepare for more elevated volatility ahead. So, while the intra-week volatility was extreme, the S&P 500 finished more or less flat on the week, and that makes sense as the macro outlook remains the same: stocks are facing three major headwinds from the hawkish Fed hiking rates, continued COVID lockdowns in China, and the ongoing Russia–Ukraine war.

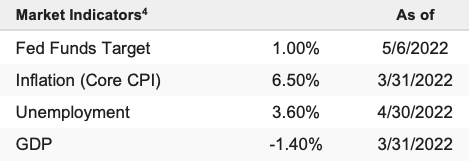

To start the year, we knew that central bank tightening would make for a challenging market. But that has been compounded by two surprise events: the Russia–Ukraine war (no one expected that in January) and Chinese lockdowns (it’s quasi-shocking the Chinese are still adopting these policies and crushing their economy).

Again, this all matters because of economic growth. Markets are down because of growth worries and it’s the three factors mentioned above that are driving markets lower (including this morning). Collective worries about economic growth are causing tech to (still) act as an anchor on the market, which happened again last week. But we have to remember that these threats to economic growth don’t exist in a vacuum. Yes, there are real threats to economic growth. Yes, economic growth is absolutely going to slow. And yes, the chances we get a recession are rising quickly.

But the S&P 500 is down 13% YTD. That’s not a small amount! The multiple on 2023 earnings, (even if we take a conservative number of $240/share), is now 17.17x, a reasonable number that doesn’t imply that much more downside before valuations become attractive. And despite last week’s volatility, the news, on balance, was slightly positive. The Fed isn’t quite as hawkish as we thought (and that makes it more likely they “back off” dramatic hikes as the economy slows). China isn’t abandoning “Zero COVID” but they are trying to offset it with stimulus, and the COVID wave is showing some signs of peaking.