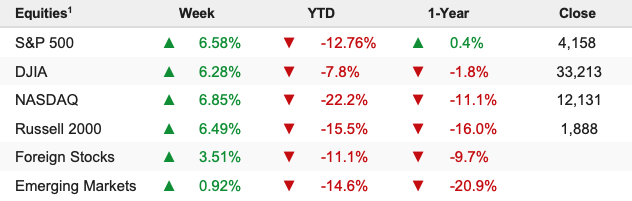

Stocks extended a relief rally last week thanks to some more encouraging retailer earnings, mixed economic data, and easing concerns about a very aggressive Fed into year-end. The S&P 500 rallied 6.58% on the week and is down 12.76% YTD.

Three Keys to A Bottom: Update

Two weeks ago, we identified “Three Keys to A Bottom” and listed specific events that would need to happen for the selling to stop. Since then, the S&P 500 has rallied 3.5%, and that’s because there’s been legitimate progress across each of the three keys. As one would expect, the bounce from the lows has elicited a lot of “Was that the bottom?” questions from investors and advisors, so I wanted to take a moment to update our “Three Keys to a Bottom” to determine if they have been met because that will tell us 1) If that was the bottom or 2) If there’s still more work to do on a fundamental basis.

Key to a Bottom 1

Chinese Lockdowns Ease and Growth Recovers. How we’ll know: China Covid cases drop, Chinese PMIs rise back above 50, and the Yuan moves back towards (and below) 6.50 to the dollar (currently around 6.75 to the dollar).

Update: Positively, Shanghai has continued to reopen, and factory production in China has grown, although it’s still not at pre-lockdown levels (that likely won’t come until late June/early July). Also positively, authorities have resisted the most draconian lockdowns in Beijing. Finally, the Chinese government appears to be backing off the idea of “Zero COVID” and the economic carnage it creates, although we likely won’t ever get an official backtracking of policy (that’s ok, markets just care about the practical application). From an indicator standpoint, the PMIs are not back above 50 yet, while the Dollar/Yuan has declined but not below 6.50 (currently 6.65).

Bottom line: There’s been progress over the past two weeks, but the key here is the growth rebound and the removal of the chance for more lockdowns, and more progress is needed before we can say this key to a bottom has been satisfied.

Key to a Bottom 2

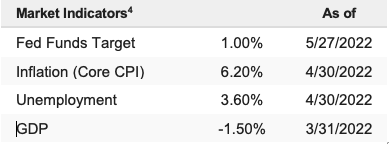

Inflation Peaks and Declines and the Fed Eases Off the Hawkish Rhetoric. CPI, the Core PCE Price Index, and the price indices in the monthly PMIs begin to meaningfully decline. If CPI can get back down near 3%-5% towards the end of the summer (August), that will likely make the Fed back off the hawkish rhetoric, confirming “Peak Hawkishness” is upon us and helping to form a sustainable bottom.

Update: Numerous signs have emerged lately signaling we’ve had “Peak Inflation” and “Peak Fed Hawkishness.” Both CPI and the Core PCE Price Index are signaling a peak. Meanwhile, the idea of a “pause” in Fed rate hikes after the July or September meeting has become more prevalent, and fed fund futures have reduced year-end fed funds by one full rate hike (from 2.50% to 2.75%), so that is a positive. But it’s still unclear how quickly inflation will decline. If Inflation very slowly declines, the Fed will remain hawkish, so the key going forward is seeing how fast CPI can drop to the lower end of the 3% to 5% YoY range.

Bottom line: There’s been progress over the past two weeks, and it appears we have met peak inflation and peak hawkishness. But the key is the speed of the decline, and right now, it’s not fast enough to say this key to the bottom has been satisfied.

Key to a Bottom 3

Geopolitical Tensions Decline. How we’ll know: Oil and other commodities will drop to pre-war levels.

Update: There’s been no material progress toward a ceasefire in Ukraine, although, in the past few weeks, Russia has gained more territory in the Donbas and maybe getting to a point where they search out some ceasefire and fully annex the seized land. Obviously, from a human standpoint, this has been an epic tragedy, but from a market standpoint, it just wants the fighting to end. If Russia largely accomplishes enough to declare “victory” and comes to the peace table, the markets will embrace that result. For now, commodities (especially oil and wheat) remain elevated and nowhere near pre-war levels.

Bottom line: No material progress.

Markets were very oversold and primed for a bounce, and certainly sentiment is a driving force behind the near-7% rally in the S&P 500 from the lows. But at the same time, we have had some fundamental progress, and largely speaking the gains of the past week to 10 days can be justified by fundamental improvement. However, it hasn’t been enough to definitively say the bottom is in for stocks.