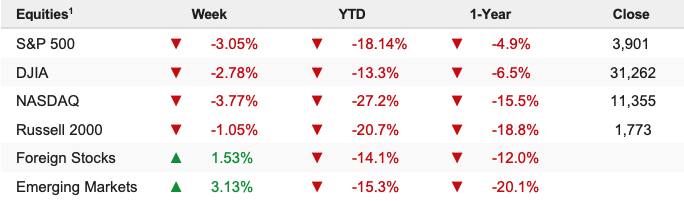

Stocks fell to new lows in volatile trade last week amid ongoing growth concerns, a still-aggressive outlook for monetary policy, and new evidence that inflation is beginning to meaningfully impact both consumer spending and corporate margins. The S&P 500 fell -3.05% on the week and is down -18.14% YTD. It was notably the seventh consecutive weekly decline in the S&P 500, the longest losing streak since 2001.

Stocks dropped again last week, and the S&P 500 made fresh lows as there was no real improvement in any of the major macro overhangs (Chinese lockdowns, Fed hawkishness/high inflation, and geopolitical risks). Meanwhile, investors got bombarded by new potential negatives via the bad TGT/WMT earnings, Beijing lockdown rumors, and the emergence of monkeypox cases around the world.

What Are the Potential Bull and Bear Scenarios from Here?

At this point, the headline noise combined with the rampant negativity in the markets and financial media is making it very difficult to separate the “facts” that would lead to a sustained bounce or a further breakdown. So, we want to take a moment this morning and clearly define what someone needs to think will happen if they are bullish here, and what someone needs to think will happen if they are bearish. The point isn’t to convince you one way or the other, but instead to make sure everyone has a clear picture of each scenario and stays focused on sustainable market-moving facts amidst all this market noise.

The Bullish “If” Scenario

No one can honestly argue there aren’t several real headwinds facing the markets. That said, the bullish scenario from here can be summed up in two thoughts: The worst is over, and people are too negative. A bullish mindset would look something like this:

- Inflation has peaked and it’s going to decline quickly, toward 4%-5% by the end of the summer.

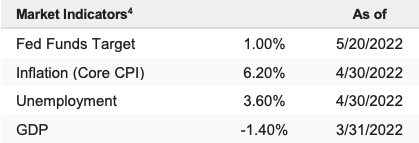

- The Fed will hike 50 bps in June and July, but the peak in inflation and slowing growth will have them turn less hawkish by late summer, removing a major headwind from stocks.

- TGT and WMT earnings were a specific issue for retailers, so falling inflation eases that pressure and we won’t see major S&P 500 EPS drops in 2022 or 2023.

- China effectively abandons the “zero Covid” policy, we won’t see any more widespread lockdowns, and authorities massively stimulate the economy.

- Near-unanimous recession fears are overblown and the economy might slow but it won’t collapse.

- The conflict in Ukraine won’t get any worse and the stalemate will force a ceasefire in the coming months.

The Bearish “If” Scenario

The bearish mindset won’t see the potential for anything to get better. Essentially, the bears just need no improvement, and for the economy to slow under the weight of rate hikes and for that to drag corporate profits lower, pushing the market multiple and earnings down.

- Inflation has peaked but it won’t recede.

- The Fed follows through on more hikes and stays just as hawkish, bringing Fed funds close to 3% by year-end.

- Last week’s Empire and Philly Fed are accurately forecasting slowing growth, and the economy will be at a standstill by the fall.

- High inflation and slowing growth (stagflation) hit corporate earnings and we see 2022 and 2023 EPS drop sharply, removing any valuation argument from the bulls.

- China continues enforcing “zero Covid” and the threat of lockdowns will hurt growth.

- Russia’s war against drags on with no end in sight.