Stocks fell to fresh 52-week lows last week as momentum remained decidedly negative while there was a complete lack of any favorable news to spark a reversal. The S&P 500 fell -2.41% on the week and is now down -15.57% YTD.

The stock collapse that started in April continues, although like much of the declines since then there wasn’t any materially bad news to justify the price action last week. And, for the past three trading weeks, the main reasons behind the drop have been momentum and technicals (essentially the selling that’s causing more selling). Friday’s solid bounce made the weekly losses less painful, and sentiment has become so negative that a further bounce here shouldn’t surprise anyone. But, before we can say that Thursday’s lows (which saw the S&P 500 drop 19.9% from the highs) are the bottom, we want to clearly identify the three events that need to happen before we can expect those lows to hold:

Chinese Lockdowns Ease and Growth Recovers

How we’ll know: China Covid cases drop, Chinese PMIs rise back above 50, and the yuan moves back toward (and below) 6.50 to the dollar (currently around 6.75 to the dollar). Rhetoric out of China is often nebulous at best, as are “official” Covid stats. Meanwhile, Chinese authorities won’t admit they’re wrong about Zero Covid so we can’t expect them to publicly abandon that policy. But they could do it in effect, and we’ll know that because the market will tell us, first via the PMIs and second via dollar–yuan values. If the dollar–yuan values retrace this decline over the past month, that’s a sign the market is confident that the Chinese economy is sustainably recovering, and that will reduce the chances of a global recession and keep any Chinese shutdown earnings declines to a minimum.

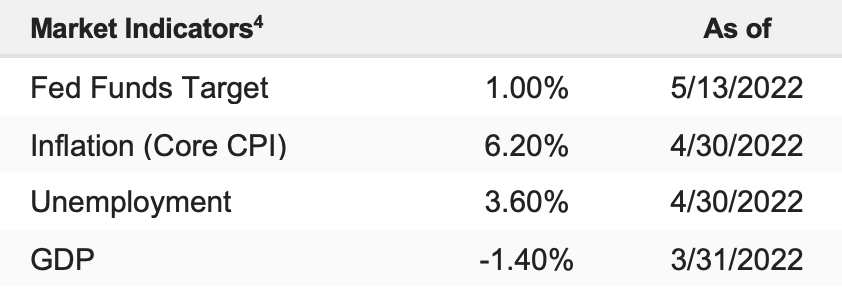

Inflation Peaks, then Declines and the Fed Eases Off the Hawkish Rhetoric

How we’ll know: CPI, the Core PCE Price Index, and the price indices in the monthly PMIs begin to meaningfully decline. If CPI can get back down near 3%-5% toward the end of the summer (August), that will likely make the Fed back off the hawkish rhetoric, confirming “peak hawkishness” is upon us and helping to form a sustainable bottom. It’s becoming more evident that inflation pressures have peaked, but that won’t make the Fed less hawkish, which is what we need to help form a sustainable bottom. In addition to the peak, we have to see inflation metrics decline in earnest, and the sooner the better.

Geopolitical Tensions Decline

How we’ll know: oil and other commodities will drop to pre-war levels. Understanding what “improvement” will look like in the Russia–Ukraine war is very difficult at this point as a ceasefire remains very unlikely. Meanwhile, the conflict seems to be devolving into a stalemate that could last for months, quarters, or even years. The Russia–Ukraine war is a tremendous human tragedy, but from a market and economic standpoint, it’s the spike in commodities that’s causing headwinds on earnings and increasing the chances of a recession in the EU. So, if we see oil move back close to pre-war levels (around $90/ bbl) and wheat falls back below $9.00/bushel (currently above $11/bushel), that will be a clear sign that the war’s impact on the economy and markets is fading (regardless of the headlines).