Volatility picked up last week as an early week rally reversed sharply on Thursday amid more data pointing to stagflation, mixed earnings, hawkish Fed speak, and a subsequent rise in bond yields. The S&P 500 dropped 2.75% on the week and is down 10.37% YTD.

Stocks attempted to rally early last week, but global governments continue to take seemingly every available opportunity to remind markets that the global stimulus that sent stocks higher over the past few years is going away quickly and not coming back, and that general idea weighed on stocks on Thursday and Friday.

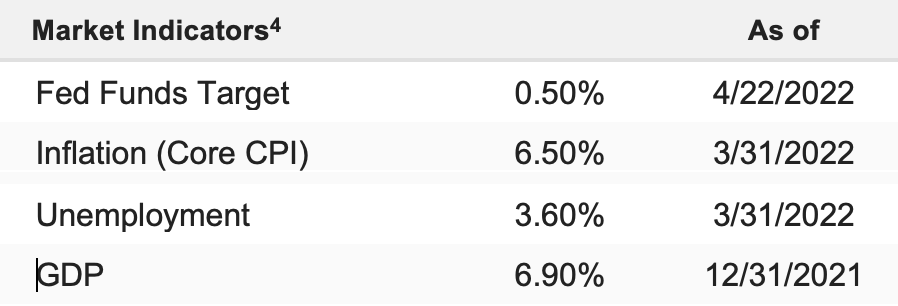

To that point, there wasn’t anything “new” that caused the drop in stocks on Thursday and Friday. Yes, Powell was hawkish in tone again, but the market already priced in a 50-bps hike in May. Perhaps the chances of three 50-bps hikes in May/June/July went up, but it doesn’t really matter—the year-end 2022 fed funds expectations are still between 2.50% and 2.75%, so it’s not like policy expectations were more hawkish last week.

Regarding Europe, ECB officials were hawkish and clearly guided markets to expect an end of QE and a potential rate hike in July. But that’s not materially sooner than expected. Meanwhile, the hawkish commentary came from hawkish members of the ECB, the heads of the Bundesbank, and the Belgian National Bank. They aren’t always ECB consensus, so we must remember that.

Finally, China is continuing with its “Zero COVID” policy, and that is a problem, first because it’s impossible to accomplish, and second because the longer they try, the more delayed a return to normal supply chain will become (which will keep inflation pressure elevated). But while the reiteration of the policy by President Xi last week was disappointing, it’s not a new negative (no one expected them to reverse course in the near term). Here’s our point: Yes, the general idea of global governments pulling support for the economy and tightening policy is a medium and long-term problem for stocks, but none of that got materially worse last week.

Meanwhile, while it’s too early to declare earnings season “fine,” it has started off solidly. Expectations for 2023 S&P 500 EPS remain at $245, which makes the valuation of this market at these levels about 17.5X, which is, frankly, reasonable. It’s still a bit early to look at the market on 2023 earnings, but that will happen over the next three months.