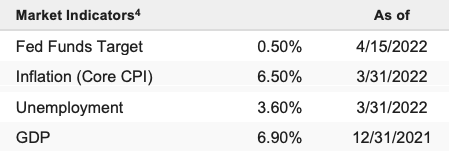

Stocks chopped lower last week amid ongoing stagflation fears and a continued rise in bond yields while the initial Q1 earnings results raised some caution among investors. The S&P 500 fell 2.39% on the week and is now down 7.84% YTD. Stocks dropped last week on multiple factors, but we continue to think that, if earnings are better than feared, the ingredients are there for a near-term rally to the upper end of the 4,300–4,600 trading range, although we remain cautious on markets beyond the short term due to looming Fed tightening.

Stocks declined during the holiday-shortened week due to several factors: more hawkish Fed rhetoric, China’s continued economic shutdowns in response to Covid, underwhelming economic data, no progress toward peace in Ukraine, and rising bond yields. But, while those factors combined to weigh on stocks, under the surface there were some potential positives.

First, on Friday, China provided more accommodation to its economy via a reserve rate cut. Second, the Empire State Manufacturing Survey, which is the first economic report for April, beat estimates implying current economic growth remains strong. Third, earnings season started “fine” as multiple companies had positive commentary about business (DAL in particular). Finally, core CPI slightly undershot estimates, potentially implying that inflation pressures have peaked. The point is, under the surface, there’s the chance the headlines turn more positive in the coming weeks, especially if earnings season is better than expected (the next three weeks will be the peak for earnings season).

But while we continue to think there’s the chance for a rally back towards 4,600, we also continue to expect that resistance to hold because the market is still facing unprecedented Fed tightening in the coming months, and that will create meaningful headwinds on the economy and markets that won’t be known until the second half of 2022.

So, we continue to expect the 4,300ish–4,600ish trading range to broadly hold. If earnings season is strong, there’s a ceasefire in the Russia–Ukraine war, and inflation shows further moderation, we could see the S&P 500 trade temporarily above 4,600, but we wouldn’t expect that to be sustainable. Similarly, if the opposite happens, we’d expect the S&P 500 to drop temporarily below 4,300 but wouldn’t expect the year-to-date lows to be taken out.