Stocks wavered between gains and losses last week as geopolitical tensions continued to simmer, and the market focus increasingly shifted to more aggressive Fed policy expectations. The S&P 500 fell 1.27% on the week and is now down 5.83% YTD.

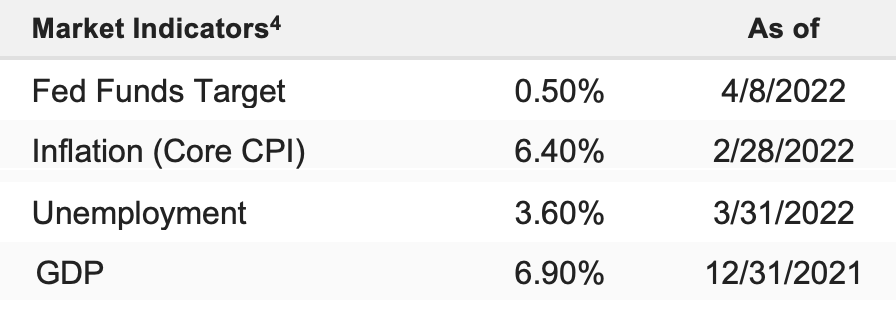

Stocks fell moderately last week as the Fed once again raised the hawkish bar on markets, with incoming Vice-Chair Brainard basically guaranteeing a 50-bps hike in May and the FOMC minutes revealing a $95 billion quantitative tightening schedule that wasn’t as bad as feared, but it was close.

While the S&P 500 failed to extend the March rally, we’re again left with the thought of “it could have been worse,” considering the market has constantly been playing catch up to the Fed’s continued hawkishness. At this point, the market and the economy are staring down the proverbial barrel of the most aggressive tightening pace in 30+ years.

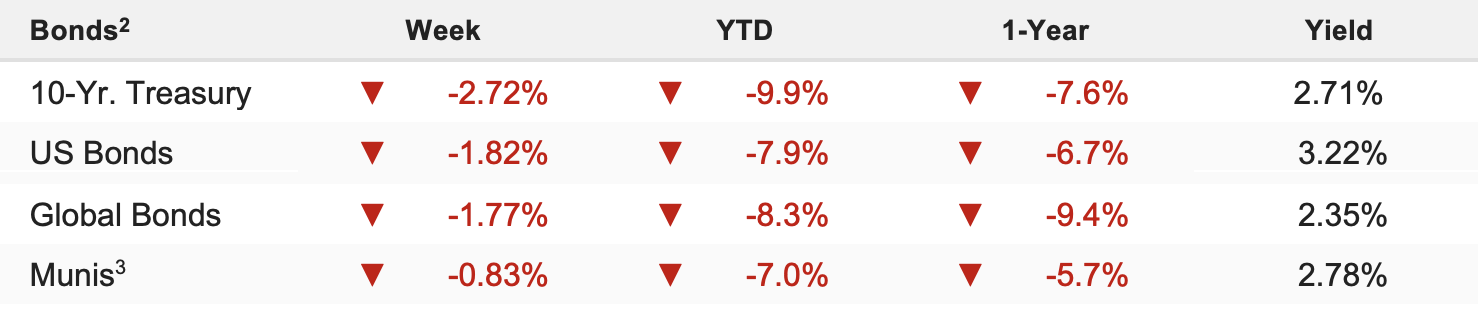

To that point, we’ve seen market-based interest rates move up aggressively—especially in the last few weeks, in response to the Fed’s hawkishness—as the 10-year yield is at multi-year highs while mortgage rates have surged above 5%, a level last seen in 2011. Again, the S&P 500 has been relatively resilient in the face of this increase. That’s why in the short term, we would not be shocked to see a rally if two conditions are met:

- Earnings season (which will occur over the next three weeks) eases concerns about S&P 500 earnings growth in 2022 and 2023.

- There’s a ceasefire in the war between Russia and Ukraine that sees an end to the escalation—both from a fighting and sanctions standpoint.

If those two things happen, we could see the S&P 500 trading through 4,600 on a temporary basis. But that will only be driven by two factors: sentiment remaining soundly bearish (so there’s a chance for a surprise rally to cause chasing like we saw in March), and investors (in the next two to three months) beginning to value the S&P 500 on expected 2023 earnings of around $243 and a 19.5X multiple can get the S&P 500 through 4,700.

But we still don’t see that rally as sustainable. That’s because we haven’t felt the impact of Fed tightening on the economy and corporate earnings, and the drag on growth and earnings is likely months away. The point being, if this aggressive Fed tightening does slow growth and hurt earnings, there’s a real risk to the current market multiple of 19.5X, perhaps as low as 18X. On a 2022 earnings basis ($225), that’s 4,050 in the S&P 500. On a 2023 earnings basis ($243) that’s 4,374, although in a slowing environment it’s unlikely that expected 2023 earnings would stay at $243.