Stocks wavered between gains and losses last week as investors continued to monitor the conflict in Ukraine and subsequent sanctions on Russia as well as mixed global economic data. The S&P 500 fell 1.27% on the week and is down 9.18% YTD.

When Russia invaded Ukraine approximately 10 days ago, we highlighted that the duration of the conflict would be the key variable for markets— and more directly how long the conflict lasted, and how sustainably high it sent commodity prices, would determine whether the war was a material bearish influence.

At this point, the duration isn’t long enough yet to make us get materially more defensive, but it’s getting close. We say that because we aren’t even seeing de-escalation yet never mind a sustainable end to hostilities. We have a similar situation with inflation. Markets need inflation to recede, but before that happens it has to peak first (i.e. stop getting worse every month) and we’re not even there yet!

Relating it back to Russia/Ukraine, first, we have to get de-escalation. Then, we need a ceasefire that holds. Then, Russian troop withdrawals. Only after all of that will we see the historically crippling sanctions levied on Russia by the West begin to be removed—and then we should see a real decline in commodity prices. At this point, however, that’s potentially weeks away (if not longer) and that’s a growing problem for risk assets.

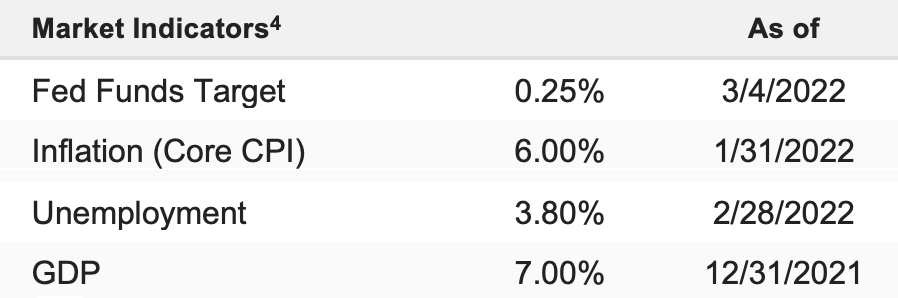

Meanwhile, the Fed remains on track to hike rates into a strengthening headwind on the economy, e.g. high inflation and exploding commodity prices, and a natural slowing of demand as fiscal spending/stimulus fully exits the system. Taken altogether, we are not ready yet to abandon our 4,300-ish—4,600 trading range in the S&P 500—but we are getting nervous about downside risks.

Before Russia/Ukraine, the Fed had little room for error with high inflation and a looming slowdown in growth. Now, Russia/Ukraine has made that job all the more difficult via exploding commodity prices, which at a minimum will reduce economic demand and put more of a headwind on the economy over the coming months.