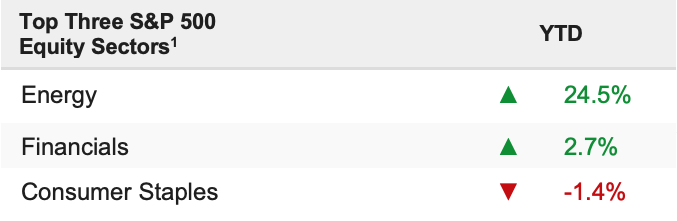

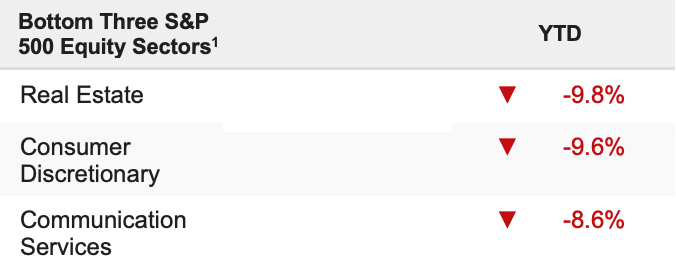

Stocks extended the recent relief rally through the front half of last week, but mixed earnings and a “hot” January jobs report saw the major indexes end off the best levels of the week as bond yields surged to multi-year highs on Friday. The S&P 500 gained 1.55% on the week and is down 5.57% YTD.

Inflation is the key going forward

Solid economic data and some downplaying of the potential of very hawkish policy actions by Fed officials helped stocks overcome hawkish commentary by foreign central banks and mixed earnings to log modestly positive gains last week.

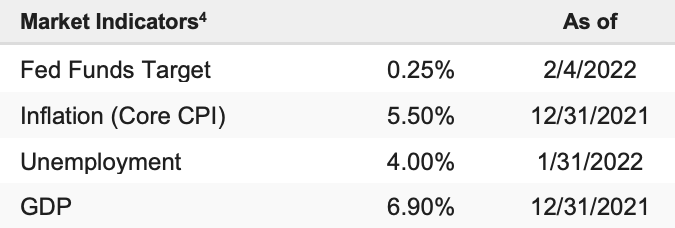

Stepping back: over the past two weeks, we’ve received the first central bank decisions of 2022 (Fed two weeks ago, BOE/ECB last week) and the Q4 earnings season (which essentially ended on Friday, at least from a market standpoint). And the takeaways are clear: global central banks are removing accommodation much more quickly than expected, which is pressuring the overall market multiple and the multi-quarter positive earnings revisions that helped stocks rally in 2021 is over.

Given those two macro-economic realities, it’s not a surprise that stocks are down so far this year and that volatility has increased. At the same time, however, markets are now more appropriately priced for this new reality. At 4,500, the S&P 500 is now just under 20x earnings (20 times the 2022 S&P 500 EPS of 226 is 4,520 in the S&P 500). That’s a full valuation and there’s likely not much more room to the upside barring a dovish surprise from the data or Fed. At the same time, it’s not that far from a 19.0x level that’s very justifiable given the fundamentals. Put more plainly, the macro outlook isn’t as good as it was in 2021, but stocks aren’t as high as they were, either.

For the January lows below 4,300 to be broken, we’d need to see: 1.) The Fed turns materially more hawkish (meaning five or six rate hikes or an aggressive balance sheet reduction), 2.) Economic growth roll over hard (increasing stagflation risks), or 3.) Earnings start to outright decline. We will get scares of some of those that will create more volatility, but at this point, any of those things actually happening is unlikely.

Conversely, for stocks to move materially higher from here (towards the old highs), we’d need to see a materially dovish shift from the Fed, which is unlikely unless growth slows—which wouldn’t be good for stocks anyway).

So, in the context of likely strong support near the January lows and limited additional upside from here, we’d continue to use any momentum-driven rally towards or through 4,600 in the S&P 500 as an opportunity to reallocate to value from growth. Similarly, barring one of the three aforementioned negative events happening, we’d use any hawkish Fed, growth, or earnings scares to add to value/low-volatility, higher-yielding quality ETFs as the S&P 500 got closer to 4,300.

Looking forward, inflation remains the key variable that will determine whether stocks can extend this rebound or we see a drop back toward the January lows. Inflation will dictate Fed policy and impact both economic growth and corporate earnings. If inflation remains hot, it will skew hawkish risks for the Fed, weigh on growth, and pressure earnings. If inflation peaks and recedes, it’ll keep the Fed on the current track (four hikes and gradual balance sheet reduction), the recovery will stay strong, and earnings shouldn’t drop.