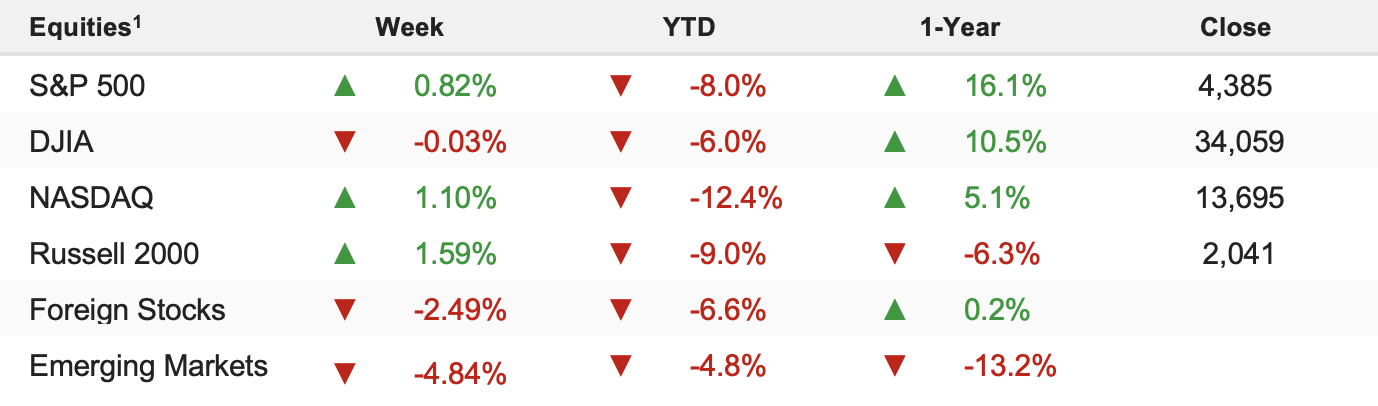

Volatility remained elevated with geopolitical tensions running high last week, but the prospects that the Russia–Ukraine conflict would be short-lived, along with mostly encouraging economic data helped stocks turn positive into the end of the week. The S&P 500 gained 0.82% on the week and is now down 8.00% YTD.

From a geopolitical standpoint, the weekend was a positive one as Ukraine continues to provide much stiffer than expected resistance to Russian forces and peace talks started today which, hopefully, will lead to a cease-fire in the near future.

Additionally, the global response and isolation of Russia increased and is now at unprecedented levels, including removing some Russian banks from SWIFT, the closing of international airspace to Russian planes, sports boycotts, and more.

This “cutting off” of Russia from the global banking system, global financial system, and, broadly, global society, has had material impacts in Russia as the ruble crashed another 30% overnight, while the Russian central bank doubled interest rates to 20% to try and halt widely reported bank runs in the country.

While necessary, these unprecedented sanctions raise the risk of financial contagion. Russia is a big economy that is totally interconnected to the global financial system and cutting them off does risk ripples hitting the European banking system and other global markets. And, considering Friday’s big rally, that’s why futures are down this morning: increased contagion risk.

So far though, there are no material signs of contagion and it appears the situation is making some progress toward a cease-fire, so we don’t see a return of last week’s lows.

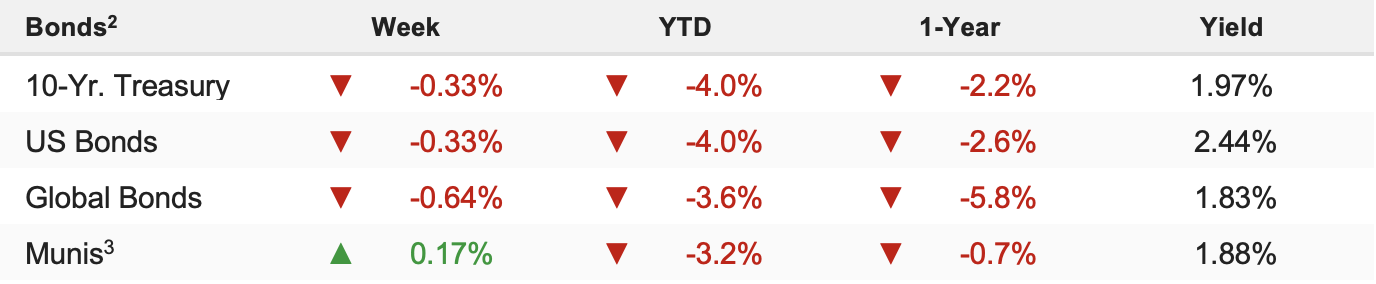

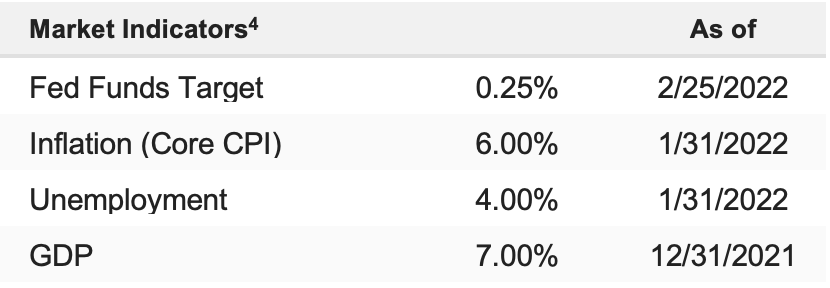

While Ukraine will remain in the news, the longer-term issue for markets has been, and still is, the Fed. Two key Fed-related questions will determine how long this bull market lives on: 1) How quickly will the Fed hike rates? 2) How dramatically will the Fed reduce its balance sheet? Barring a major setback of progress regarding Russia–Ukraine that increases the chances of a Russia vs. NATO conflict, the bottom line is that the Fed is the major issue for stocks going forward.

Positively, we will learn a lot more about this Fed over the next two weeks via Powell’s testimony this week, the rate hike decision on March 16 (25 bps or 50 bps), “dots” that show how many hikes we can expect this year (four or five?), and further clarity on balance sheet reduction (how quickly and are there asset sales?).