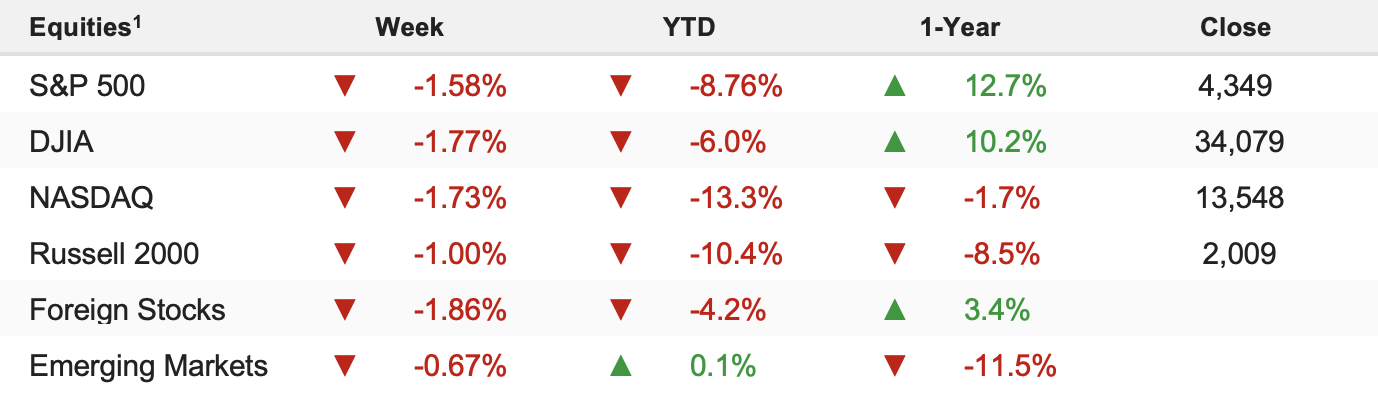

Equity markets remained volatile last week as investors eyed escalating geopolitical tensions surrounding Russia–Ukraine and digested mixed economic data ahead of monthly options expirations on Friday. The S&P 500 fell 1.58% on the week and is down 8.76% YTD.

The Russia–Ukraine situation remains very fluid and tensions remain high. In the short term, that will remain a headwind for stocks. Over the weekend, President Biden continued to issue warnings that a Russian invasion was imminent, although a meeting between Secretary of State Blinken and Russia’s Sergei Lavrov is still scheduled to occur (as long as that meeting is still on schedule, an invasion remains unlikely).

The market has priced in at least some conflict between Russia and Ukraine. But a full-scale invasion of Ukraine still remains unlikely. Instead, the more likely case is for Russia to do a repeat of Crimea and annex all or part of the Donbas region, which is precisely what President Putin did when he recognized the independence of the Donetsk and Luhansk over the weekend. Despite ominous media headlines, however, Russia recognizing the independence of those two regions and moving troops there is not the type of invasion markets were fearing.

Looking forward, if the meeting between Blinken and Lavrov is canceled, that would be a clear negative sign that a conflict is imminent, which would weigh on stocks until the full scope of the operation is known. But while the headlines surrounding Donetsk and Luhansk led to more volatility overnight, if the conflict ends here, that likely would cause a reflex rally as again this is not the invasion investors have been fearing.

But while Russia–Ukraine will dominate near-term headlines, it’s not what’s going to determine the medium and long-term direction of this market. Those two factors remain Fed tightening and economic growth.

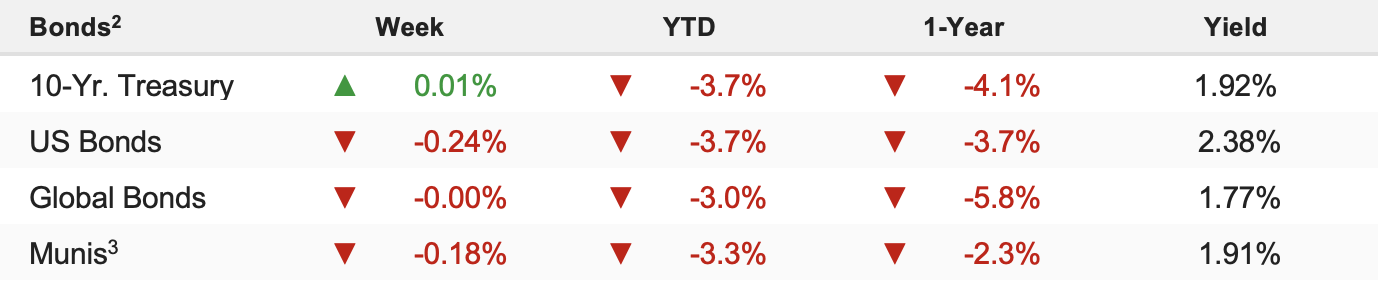

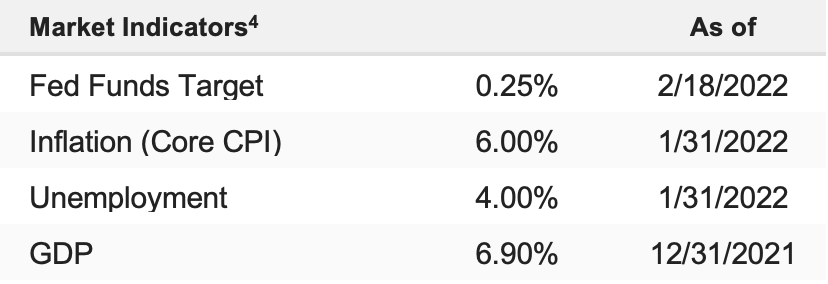

So, the key questions for markets remain: how quickly will the Fed hike rates and, more importantly, how fast do they shrink the balance sheet? On growth: will we see a natural slowdown in the coming months, and if so, at what point does that get the Fed to be less hawkish?

For now, we think the market has appropriately priced in Fed hawkishness and a mild slowing of growth. That’s why, given what we know now, we think the January lows can hold. As such, we continue to view any dip in the S&P 500 toward 4,300 (including this one) as a tactical buying opportunity for value positions and low-volatility ETFs.

Conversely, we view 4,600 as a “ceiling” in this market until we have more clarity on the Fed’s plans for tightening, and we’d use any relief rally toward that level to continue to rotate out of tech and high-multiple growth stocks (and into value).