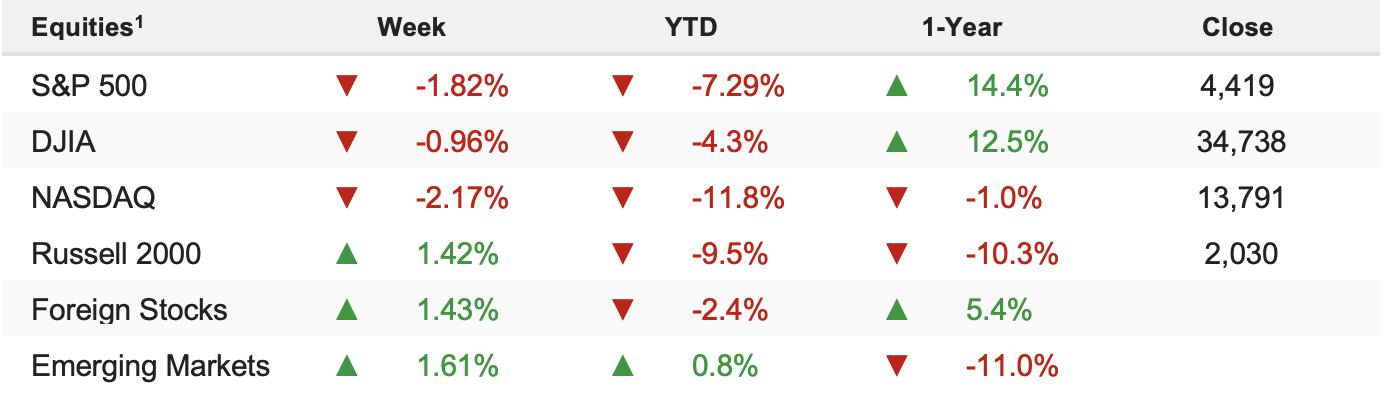

Stocks remained volatile last week as the major indexes attempted to extend the recent relief rally in the front half of the week before hot inflation data, hawkish Fed speak, and rising geopolitical tensions combined to spark a sharp selloff in the back half of the week. The S&P 500 fell 1.82% on the week and is down 7.29% YTD.

Stocks dropped last week thanks to end-of-week volatility, as a hotter-than-expected CPI report, hawkish commentary from more Fed officials, and ominous headlines about a potential Russia–

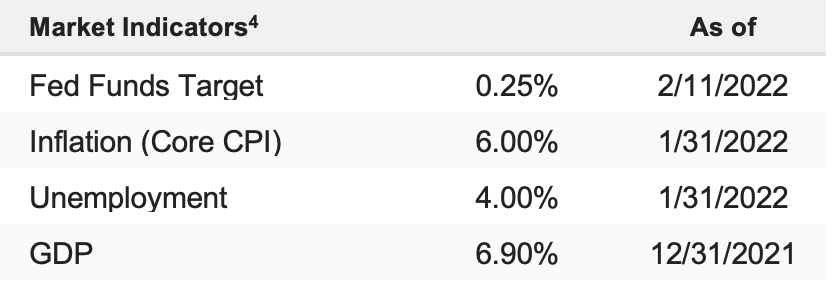

Ukraine conflict weighed on markets all day Thursday and Friday afternoon. But, while markets were volatile last week amidst seemingly materially negative headlines (inflation at a 40-year high a 50-bps hike in March, and uncertainty about a Russian invasion), the truth is not much changed from a macroeconomic or market outlook standpoint.

Going into last week, the major issue for this market was how quickly the Fed will remove accommodation and the headwind that’s putting on the market multiple, essentially “capping” the S&P 500 at roughly 4,500 from a fundamental standpoint.

And, as we start a new week, the major issue facing this market is still how quickly the Fed will remove accommodation. Despite the volatility last week, the Fed outlook didn’t change that much. CPI was hotter-than-expected, and it increases the chances of a more aggressive Fed, but Bullard’s call for a 50-bps hike in March and 100 bps of tightening by June isn’t consensus and that’s not the most likely outcome. Four rate hikes in 2022 are still the most likely path of rate hikes.

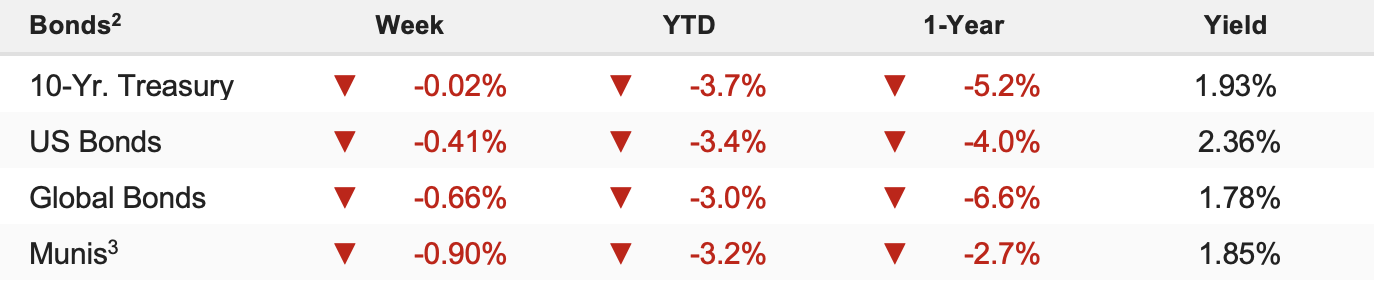

We know the Fed is hawkish and we know they are raising rates. That will be a consistent headwind on markets going forward and for the foreseeable future. But that doesn’t mean a bear market has started. Eventually, the Fed will hike rates too much and kill the recovery but that could still be a year or more away (that’s why we’re watching 10s-2s spread in treasuries).

In the meantime, though, it does leave this market susceptible to other potentially negative headlines, such as the Russia–Ukraine conflict. It’s not that a conflict is automatically a sustainable negative for stocks, but in the context of the Fed being hawkish and looming rate hikes (and with the S&P 500 at the top of its valuation ceiling), that leaves no room for error and any additional negative macro headlines will cause volatility regardless of how fundamentally negative they actually are.

So, what does that mean practically? At this point, we view the S&P 500 under 4,400 as increasingly attractive towards the January lows on a risk/reward basis. Conversely, we view this market above 4,400 in the S&P 500 as unattractive on a risk/reward basis. We continue to think volatility will remain elevated with that trend continuing going forward.