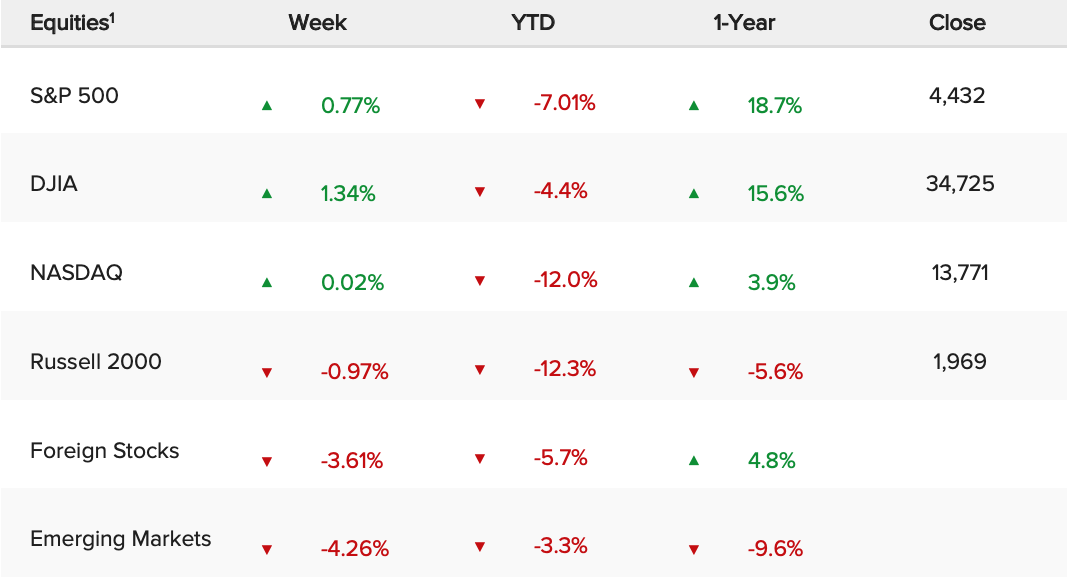

Equity markets remained volatile amid rate hike fears and simmering geopolitical tensions last week, but a late rally Friday saw the major indexes break a three-week losing streak. The S&P 500 edged up 0.77% on the week and now is down 7.01% YTD.

Technically speaking, the S&P 500 spent most of last week violently oscillating between roughly 4,300 and 4,450, but Friday’s late-day rally that saw the S&P 500 turn positive for the week was encouraging and suggests that (depending on the market catalysts or news flow to start the week) we could see a continuation higher and a relief-rally carry the index back toward the 4,600 area.

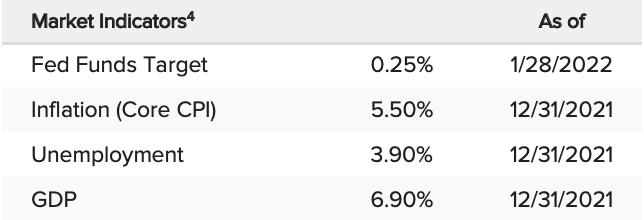

It would be a mistake to assume that we will automatically return to new all-time highs and that market volatility is over. However, as Fed policy expectations and rate hike fears have proven to be capable of sending the broader market down by more than the 5% dips we saw in 2021, periodic corrections are not only possible but could be the new normal. It’s also worth noting that Friday’s rally in the S&P 500 stalled at the 200-day moving average and that price level at 4,435 will be the first hurdle the market will need to clear (on a closing basis) to move higher this week. If the market can break higher to start the week, look for support between 4,330 and 4,380 in the S&P 500 to hold to a modest pullback, but a breakdown and close at new multi-month lows would open the door to a swift pullback towards 4,000.

The markets are due for a bounce, but the volatility isn’t over.

Stocks surged Friday—which helped turn the S&P 500 positive for the week—because inflation data (especially the Employment Cost Index) wasn’t as bad as feared, and that offered hope that inflation pressures are peaking.

Normally, that wouldn’t cause a 2.4% rally in the S&P 500. But throughout January, the market has priced in a very, very hawkish Fed, so much so that there is now room for “dovish” surprises to help stocks rally near term. And, to a point, that’s what we got on Friday. This relief-rally can continue if we get solid earnings this week and more dovish hints (either via the data or Fed speak) towards (and possibly through) the 4,600 target.

But while it’s possible the market got “too hawkish” and a mild “dovish” shift in those expectations could cause a relief rally, the case remains that the Fed is removing accommodation and that will pressure the market multiples. And, until there’s Fed clarity, we do not see this market being able to approach the old highs or set new highs.